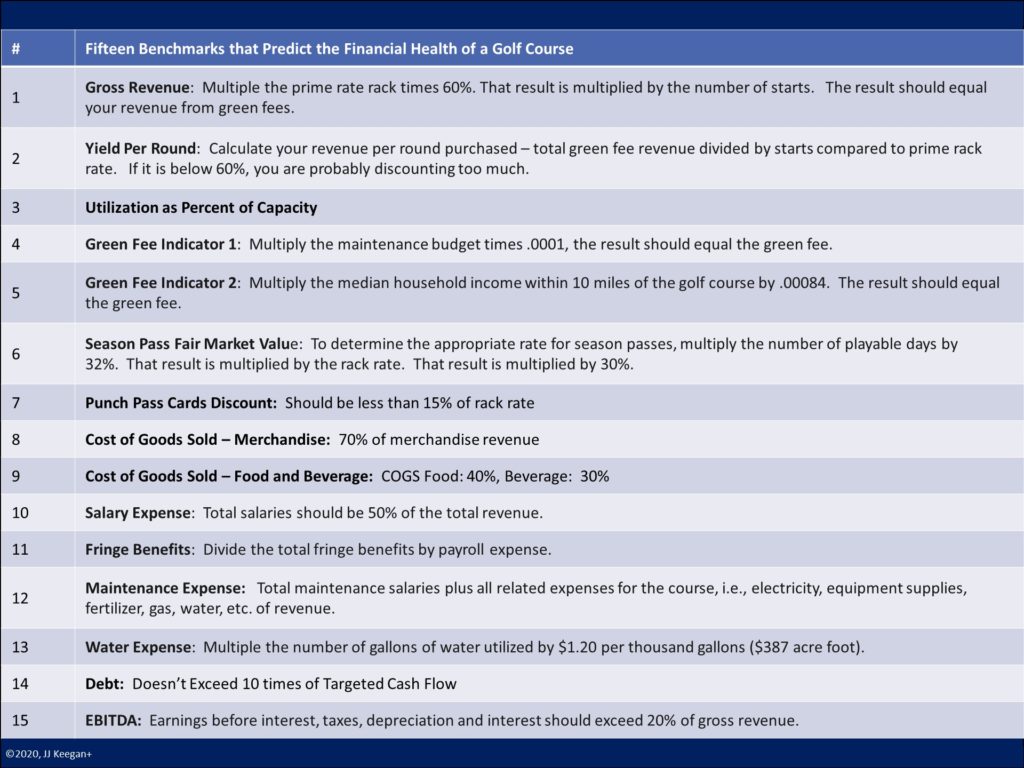

There is a slightly expanded set of significant numbers used to fine-tune the financial results of a golf course. Key Performance Indicators (KPIs) are vital tools to guide the golf course manager to optimize the financial performance of their golf course.

From a macroeconomic perspective, you can learn the green fee revenue of any golf course by asking two questions: What is your rack rate, and how many rounds of golf (starts) did you have during the past 12 months? If you multiply the rack rate times the number of rounds times 60%, you have a close approximation of the course’s gross revenue. The question about the number of played rounds is deemed not to be intrusive — merely casual conversation at the course.

Beyond estimating green fee and cart revenue, based on your intuition as to the location of the golf course and the neighborhood you observed driving to the course, you can reasonably estimate the financial potential of the golf course and that of the competitors.

By viewing the size and condition of the clubhouse, examining the quality of the turf at the driving range, walking onto the practice putting green, and counting how many employees you see, you can reasonably estimate the economic viability of the golf course.

We glean insightful clues as to the profitability of the golf course from learning:

- How many season passes or memberships do you sell, and at what rate? The less, the better.

- What is the revenue per round? If it is less than 50% of the rack rate, too many discounts are offered.

- How large is the pro shop? A small pro shop with little inventory is unlikely to generate over $100,000.

- Do golfers principally use the food and beverage services, or do you have a large number of outside dining guests for lunch and dinner? If the facility has only a snack bar or small restaurant, it is unlikely to generate over $100,000 in sales.

- Does the facility have a large banquet and wedding venue? If so, revenues for those activities can exceed $1 million.

- How many leagues, tournaments, or outings are conducted? At most golf courses, these events average about 33% of total play.

- Regarding expenses, several numbers provide the big picture:

- What is the fringe benefit percentage? If it is greater than 40%, the golf course is likely to be losing money. If the number exceeds 40%, It is advised to privatize the golf course through a third-party management company if the amount exceeds 40%, where 22% to 26% is usually achieved.

- What is the cost of water and utilities? If water is over $100,000, there is a real concern.

- Are maintenance expenses between 31% and 45% of total revenue? If maintenance expenses exceed 50% of revenue, issues abound.

- How many labor hours dare you to invest in maintaining your golf course? If in the Northern climate, budgets exceeding $17,000 generate an alarm. In a Southern climate, hourly budgets exceeding $28,000 are a reason for concern.

- Does the outstanding debt exceed $1 million at a public facility and $3 million at a private club? If so, there should be a concern about the ability to service debt.

- What are your deferred capital expenditures (CapEx), in comparison to your capital reserves? If your deferred CapEx is greater than $3 million more than capital reserves, congratulations, you have entered the death spiral of declining revenues by providing a deteriorating golf experience. The cost of borrowing will exceed, in all likelihood, the ability to service debt through cash flow. The option for private clubs becomes member assessments. Each assessment is likely to result in a loss of members, up to 10%.

It is surprising that so few numbers can tell such a significant story about the probably financial success of a club. This methodology is called heuristics. Heuristics is a science founded on experience-based techniques for problem-solving, learning, and discovery that finds a solution, which is not guaranteed to be optimal but is good enough for a given set of goals. Where the exhaustive search is impractical, heuristic methods are used to speed up the process of finding a satisfactory solution via mental shortcuts to ease the cognitive load of making a decision.

For the golf industry, which mostly lacks a detailed financial or operational orientation, an analysis of 15 numbers provides a clear picture of the financial health of a golf course.

Knowing and using these 15 benchmarks for any public golf course will provide significant insights into its financial potential.

Author: James J. Keegan, Envisioning Strategist, and Reality Mentor. His sixth book, “The Winning Playbook for Golf Courses: Shorts-Cuts for Long-Term Financial Success,” was released on June 20, 2020, Click Here. Keegan was named one of the Top 10 Golf Consultants and Golf Advisor of the Year in 2017 by Golf, Inc. Keegan has traveled more than 2,996,000 miles on United Airlines, visiting over 250 courses annually and meeting with owners and key management personnel at more than 6,000 courses in 58 countries. Click here

© 2021, JJKeegan+