Golf courses set their rates based on one of the following irrational formulas: 1) Last year’s rates with a slight increase; 2) What they think the competitors are going to charge; 3) What their most loyal customers lobby is appropriate. It is a rare occasion when a golf course sets its prices based on the value of the experience created.

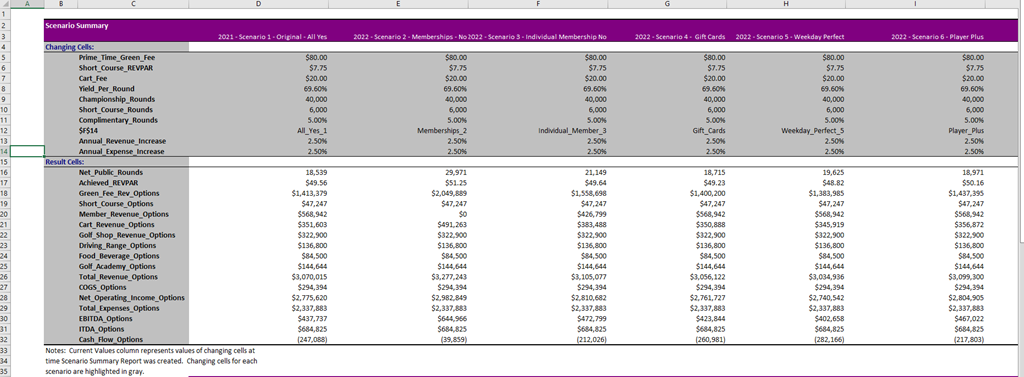

While many golf courses create annual budgets, few courses undertake a scenario analysis with Excel Data Tables, revenue modeling, and What-If Analysis as shown here:

As a result of not understanding optimizing the blend on their 80 rates, the typical golf course is forgoing annual revenue exceeding $100,000.

Recently, we had a client who undertook an extensive analysis of their operations. We identified that the current blend of rates based on 2021 operational data resulted in a shortfall of $400,000 on the annual revenue.

The culprit was a plethora of different discount options:

- Corporate, family, and individual cart memberships for 4 days, 7 days, and during twilight hours.

- Corporate, family, individual, and junior unlimited green fee memberships for 4 days, 7 days, and during twilight times.

- 50/$100/$200 gift cards that included a free round of golf.

- 5 and 10 round punch cards.

- Loyalty card options that provided discounts of 10% or 20% on Monday – Thursday or every day of the week.

- Complimentary Rounds

- League and Tournament Program

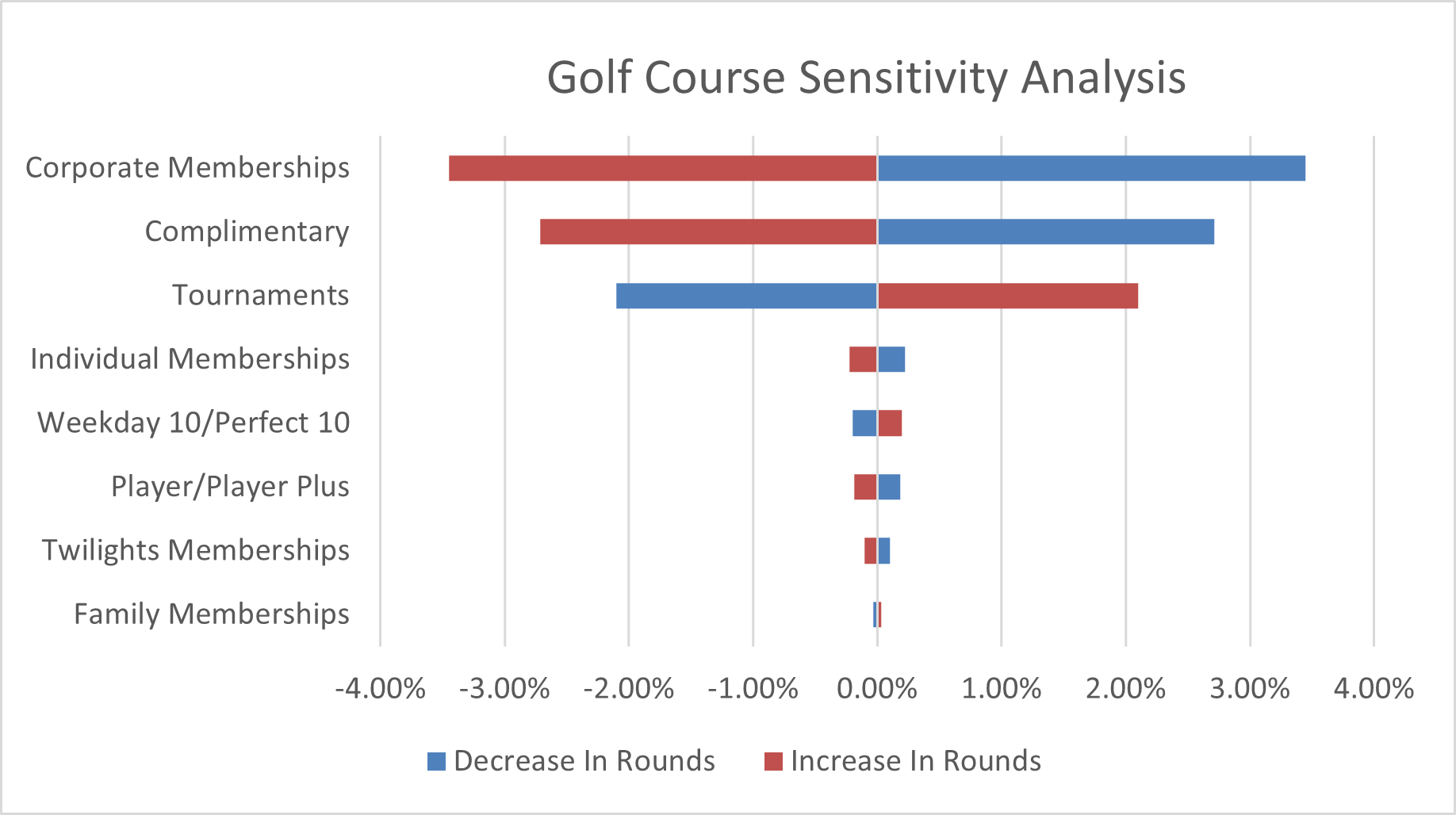

The Scenario Analysis quickly identified which programs were having the largest financial impact on revenue realized:

Corporate Membership and Complimentary Rounds had a material negative drag on revenue. As rounds in those programs increased, gross revenue decreased. Conversely, tournament play was very beneficial. All of the other programs offered were, in all significant and material respects, revenue-neutral.

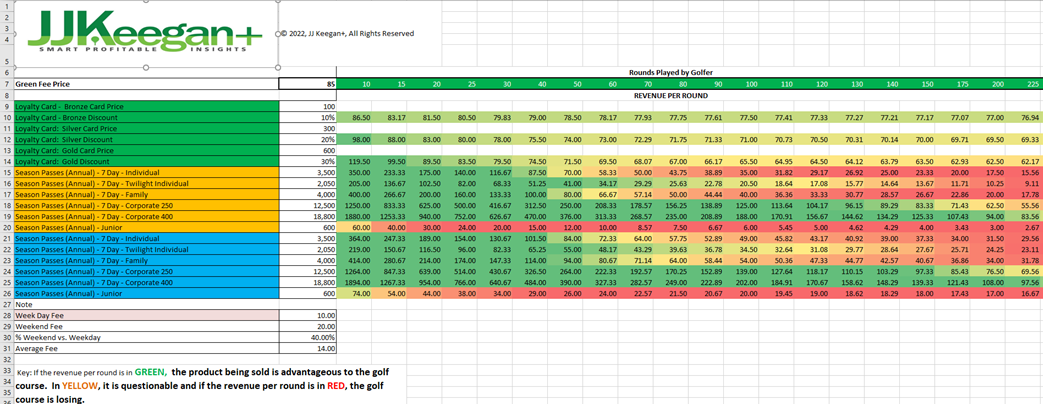

Having long been a proponent of loyalty cards vs. unlimited season play passes, a comparison of those two options clearly demonstrated the revenue leak that occurs with season passes:

It took over four weeks to build the cash flow model that included the creation of What-If scenarios, rate sensitivity modeling and data analysis on the relative break-points of punch passes and annual memberships. The five-year cash flow model included all permutations of revenue combinations and integrated all expenses by general ledger account to provide a reliable forecast.

We are pleased to report that the client has engaged in significant changes for 2022 that bode very well for their financial future including a small rate increase and the elimination of some membership and program options.

The model that we built is so comprehensive that we are confident that for every daily fee and municipal course, we can create an accurate financial forecast for your facility in a day. All we need is your 2022 rate schedule, point of sale unit sale and revenue for 2021, staffing levels by department and expense detail.

If you have an interest in optimizing your revenue for 2022, email me at jjkeegan@jjkeegan.com or call 303.596.4105. We will undertake this one-day financial review for $1,975 now. You have a second option. We will defer your investment in lieu of receiving on December 31, 2022, 25% of the incremental cash flow compared to the 2021 EBITDA that we are able to create for you. We are hoping you select the latter. The first option is far better for you as it will generate >50 times return on your investment.

Peter Aiello

An excellent and thought provoking article that all golf course operators would be advised to heed. As always however the devil lies in the details the biggest one being actually implementing the recommendations which will take courage on behalf of the operator trapped in the hide bound traditionalist approach that most are.