During the past six weeks, we have conducted golf consumer surveys in Kentucky, Massachusetts, Texas, and Wisconsin.

We are beginning to ponder whether these “electronic convenience surveys” of golfers are truly reflecting the sentiment of all that play at the golf course. What has surprised us is the average age of the golfer who typically responds as shown below:

Humorously, we almost need to add additional age brackets of 65 – 74, 75 – 84 and over 85. The Town of Barnstable reported via their Consolidated Annual Financial Report that 70 of their 1,142 seasons pass holders was over 80. Almost 60% of Barnstable season pass holders are seniors.

Clearly, millennials which represented a significant portion of the client file elected not to respond. Are they so wedded to mobile devices that a survey historically meant to be taken via a laptop or desktop computer generates no interest?

What is noteworthy is the consistency of the golfer’s responses. Regardless of location, the sentiments expressed by the golfers are nearly identical. Here are three important perspectives.

Lesson 1: Seniors + Season Passes = Self Entitled.

In one of the surveys conducted, the HIGHEST PRIORITY that the course was requested to address was the preservation of season passes – unlimited golf for $850.

A member of a Golf Advisory Board had the temerity to write:

“Page two of the RFP (Request for Proposal) specifically states under Scope of Services that the ‘specific assessment goals include the following’ – GOAL 4: CONDUCT A PROPRIETARY SURVEY OF OUR MEMBERS TO MEASURE CUSTOMER LOYALTY AND SATISFACTION.

Survey results attained from any other group of individuals fall outside of the scope of this assessment and should not be used in any quantitative way towards the final assessment.

The City allows all residents/taxpayers to “chime in” on school issues because every resident/taxpayer has a financial commitment to our school system whether they use it or not. This is not the case with golf, where no taxpayer has paid a dime toward its operation.”

Golfers responded that preserving their membership status was by far and way the biggest priority the City should ensure.

The fact is that the City’s Golf Enterprise Fund balance that is negative, ran an EBITDA deficit last year nearing $150,000, is over $2.5 million in debt and deferred capital expenditures exceed $1,500,000. Spare me that no taxpayer has paid a dime towards its operation. They certainly will shortly.

With season passes someone also loses in which resentment arises: the golfer who purchases it and fails to use it, or more frequently, the golf course management team who begin to despise the plethora of golfers paying less than $10 per round.

Loyalty cards are a far better option. We have developed an EXCEL template to guide golf course owners in the proper pricing of season passes and the issuance of loyalty cards. A $199 investment, which 30 minutes of online training, will generate a returned exceeding $20,000 if the sage guidance the exercise generates is implemented. Click here.

If season passes are offered, they should be priced based on the number of playable days times a 25% frequency of play offering a 30% discount from the prime rack rate. We have a template that is available to help you make this calculation. We will provide complimentary copies for the first five people who call.

Lesson 2: When Asked a Question About the Finances of the Golf Course, Golfers Will Always Respond based on their self-interest rather than the more altruistic balancing their interests with that of the golf courses.

If a question is asked, what is the value of the golf experience you received for a prime time green fee on Saturday morning, given the choices $30 – $34, $35 – $39, $40 – $44, $45 – $49, $50 – $55, if the rack rack is currently $45, golfers will select $35 – $39 as to the value they are receiving.

Why? They are smart enough to know that if they selected $30 – $34, the answer would be dismissed knowing that they were intentionally low balling the value. Thus, they select the next higher bracket trying to fool the golf course operator that their selection is actually the fair market value hoping the golf course manager will reduce the rack rate.

Another question that reflects a golfer’s bias in answering a financial question is shown below:

Golfers fail to grasp that in the allocation of a City’s resources, police, fire, utilities, streets is core. Important are those activities that private enterprise is unlikely to engage in: parks, ball fields, pools, etc. The golfer is labeled as “Discretionary” in the National Parks and Recreation allocation model. The sole exception is that some City’s might class as “Important” golf activities that focused on juniors and new entrants to the game, i.e., Par 3 courses.

Thus, if every municipal golf course in America would close, everyone would still have the opportunity to play golf, albeit at a daily fee or private club.

The question was also asked in the recent surveys, “Which Course Should Close?” In one case, the City is losing over a million on golf annually and has nearly $40 million in deferred capital expenditures. The golfer’s answer: 70% stated that all golf course should remain open and that none be re-purposed or sold.

Self-interest dominates when someone else is spending the money.

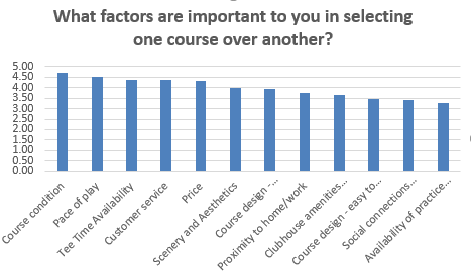

Lesson 3: Why Do Golfers Select One Course Over Another

For years, the answer to this question was Conditioning or Price. The price might finish first in low income or senior communities.

No longer, as shown below, Conditioning and Pace of Play ranked 1 and 2 in the surveys just completed.

The Lessons Learned

Discounting, which abounds, and allowing the well-to-do self-entitled to set policy is cancer that is weakening the financial foundation of the golf course industry.

Posting rates to match competitors, based on last year’s prices or based on antidotal information of your customer as to what they are willing to pay is the shortcut to cash flow deficits.

A golf course owner has to understand the value that they are creating for the customer and have the confidence and discipline to post rates that reflect that value.

The golf experience comprises many components including the slope rating, conditioning, the turf texture (bent vs. bermuda), ambiance, amenities offered, the MOSAIC profile within 10 miles of the golf course as well as the demand vs. supply that exists. If you need help in determining the fair market value of the experience you provide, Click here.

It would be our pleasure to guide you to create value for your golfers on a foundation that optimizes the financial performance of your golf course. Merely call 303 596 4015 or email jjkeegan@jjkeegan.com with your question or dilemma.

Rico R.

I think your approach to seniors and season passes is shortsighted. Seniors add more value and income to a course beyond their green fees. Seniors are more apt to rent a golf car than other age groups which will add another $10-$20 per round for the course. Seniors are also more likely to arrive early and buy a bucket of range balls at $5. They often stay after the round for a drink, snack, or lunch. Seniors also represent the age group that takes the most golf lessons.

In many cases seniors spend more money on these exras than they spend on their green fees.

JJ Keegan

While the additional spending may be true with respect yourself, and greatly appreciated by the golf course owner, from our analysis of over 2,000 facilities, unfortunately, the statistics you cite are not accurate in the aggregate.

Matt Just

This is spot on. I experienced it all first hand. From my seat in the ivory tower to behind the pro shop counter. Funny enough, my retired father who was a very successful park and rec director plays golf 4 days a week and has a senior season pass at his home course and I explained it to him. He gets it because I had to explain it from the operator perspective. In business you want a win/win.

Jim

In don’t understand what is fueling your animus toward seniors. And you certainly jump to conclusions about why golfers make choices. (Lesson #2). I see your data on the Financial Benchmarking, but where is your data to back up your assumptions about why golfers made those choices? It is pure speculation on your part as are many of your assumptions in this post.

While you rail against senior golfers and their season passes you fail to see their importance and the contribution they make to the fiscal solvency of golf courses. To understand this you simply have to remove them from the equation. There is no golf course on the planet that can exist without senior golfers. You imply that they aren’t paying their fair share but in actuality they are playing at times of the day and week that would otherwise go unfilled. So the real choice is to have a discounted golfer play or to have no one play.

You also fail to take into account the possible loss of golfers and revenue because of loyalty cards and/or increases in season pass fees. Where is the break even analysis on this?

Finally, you fail to flesh out the best ways owners can add value to the golfing experience: Course Conditioning and Pace of Play. The fair market value of the golfing experience is highly correlated to these two factors. As these improve your fees can increase.

Jim

Michael A Kahn

JJ, Your studies are so far ahead of the golf course business mentality that I fear you speak to deaf ears. We both know the industry has been headed by barnyard roosters up to the point of the brick wall the industry is now experiencing.

The area that is still being completely ignored is the huge crowd (estimated as high as 40.1 million by NGF article, April, 2017. I mean the current approach to pricing is a strategy to entice a golfer to play ‘here and not there’ so I can pay my fertilizer bills.

I just spent two weeks on the edge of a lake in Ontario discussing the golf industry with a person from another section of the business world. I learned that the golf industry uses marketing tools from the 19th century – hot air balloons VS rocket ships – so to speak.

I know you are helping savvy golf course owners compete in the golf marketplace. However, why are you still ignoring strategies to get at the 12% of North Americans who are banging at golf’s door to get in!

It’s time for a new think tank. But the roosters need to step aside. Golf needs an entirely new approach. It needs diversity. It needs to be like the auto industry – I mean a car with features at a price that fits the array of buyers out there. Golf courses created since the eighties are Rolls Royces – period. All courses built since 1980 are too long, too difficult, and too expensive. Golf needs the Toyota Camry, the Chevy Cruze, and Honda Civic.

Let’s get it started.

Michael A Kahn

In golf since 1955

Austin

I love golf, but this article expresses perfectly my sentiment that golf cultivates (or magnetizes) an “it’s all about me” mentality. Being in the industry myself going on 5 years, the attitudes most golfers have (seemingly in the older generations more so), is that they are entitled to a most amazing experience for what amounts to maybe $20 out of pocket each round. It’s pretty astonishing. Most golfers take it for granted; not sure what can be done about it.

Peter Aiello

James: a very interesting study once again supporting the contention that golfers first and foremost base their opinions on preservation of self interest. That means low rates or discounted golf regardless of the negative consequences for the golf course operator. Unfortunately the discount mentality has infected the industry such that use of it appears to be the primary tactic employed by operators many of whom do not comprehend the long term implications. Watch the golf channel and be endlessly assualted by GolfNow ads all blaring out “save x% on green fees”.

It takes a courageous operator to fight this trend, stand firm in their pricing and let the chips fall where they may. The topics you cover in your article apply not only to municipal courses but to all play for pay courses. Thank you for the information – may operators read and embrace it.

Peter

Michael A Kahn

Peter, Well said! Dumbest industry on the planet.