The Real Answer Requires An Extensive Analysis

The quick answer is yes. However, what is clearly up for debate is the type of golf experience a municipal facility should provide and how it should be funded?

Based on an analysis of 44 variables, we have identified the Top 100 municipal golf courses that should be thriving and the Bottom 100 municipal golf courses that should close today.

The top golf courses share these characteristics:

- They all located in the 16 states within the top 20 core-based statistical areas in the United States, where demand vastly exceeds supply. They average 7,831 golfers per 18 holes within a 10-mile radius.

- The annual spending by residents for golf within 10 miles per 18 holes averages $9.4 million.

- The median MOSAIC profile index, which reflects the attitudinal behavior of residents within 10 miles to golf, is a negative -.97% which indicates that the ideal golf course would have a slope rating of 120 which, ironically, is the average slope rating of a golf course built before 1980.

In contrast, the bottom 100 share these characteristics:

- Supply vastly exceeds demand as they average only 488 golfers per 18 holes within a 10-mile radius.

- The annual spending for golf by residents within 10 miles per 18 holes averages $356,740.

- The median MOSAIC profile index, which reflects the attitudinal behavior of residents within 10 miles to golf, is a negative -.23.06% which indicates that the ideal golf course would have to be an entry level facility with a slope rating of 113, an executive length golf course or a par three facility.

The characteristics of the winners vs. the losers are clear and provide a lesson to the 2,480 municipal golf courses in America.

SOME BACKGROUND

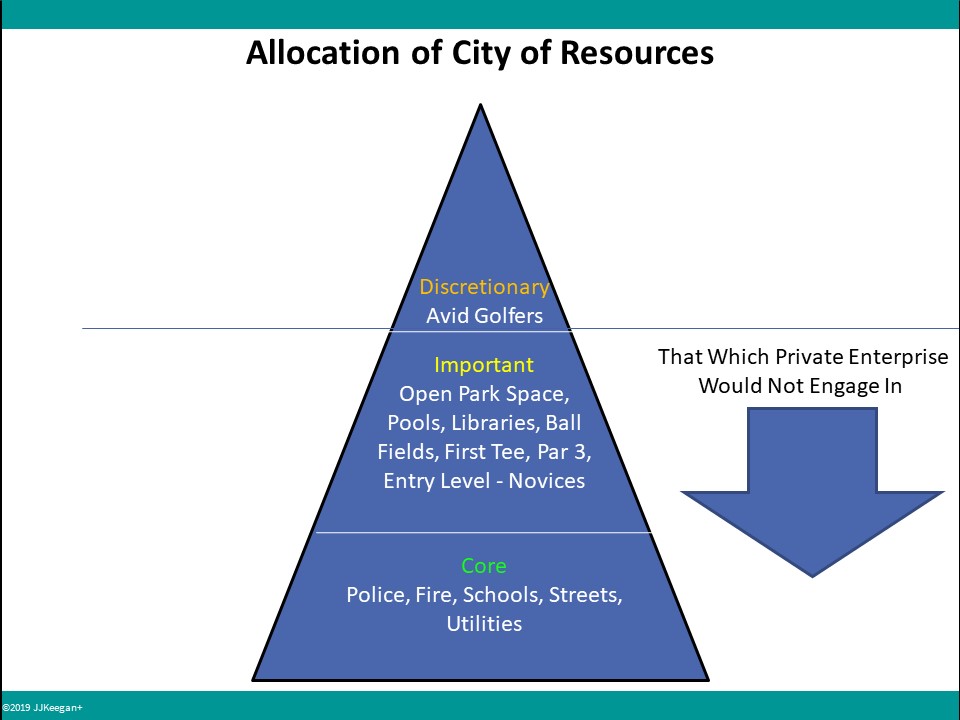

In the national model for a City focusing on the allocation of their resources, governments are typically engaged in those activities necessary to provide a quality of life that private enterprise would not engage in as highlighted below:

THE HARSH REALITY

The harsh reality is that every municipal golf course could close in America, and citizens would not be denied the opportunity to play golf. Albeit, it might be more expensive, less convenient, and perhaps more time-consuming. Every individual who desires to play golf would have the opportunity on over 8,500 daily fee or 3,750 private golf facilities in America.

The argument frequently made by golfers is that Cities subsidize parks, pools, and libraries, and so golf courses should be allocated the same level of financial support, falls on deaf ears, at least to me. There is no economic incentive for private enterprise to fund open park space, pools, libraries, or many of the other social services the government provides to enhance the quality of life for its residents. Golf is different. There are viable alternatives beyond municipal golf courses.

THERE ARE INTANGIBLE BENEFITS OF A GOLF COURSE

Thus, It is important for a City Council to answer the question, “Is the Golf Course a Community Asset or a Business Enterprise?” Golf courses provide many benefits to residents, including, but not limited to, the following:

- A healthy recreational outlet for residents and enhancement to the overall quality of life.

- Promotes a game which inculcates in its participants’ life skills, such as courtesy, judgment, honesty, integrity, sportsmanship, respect, confidence, responsibility and perseverance.

- A venue to attract visitors and prospective residents.

- A good reflection on the image/brand of the city and community.

- Enhancement to local property values.

- Golf-related jobs and income to the community through purchases, wages, and taxes.

- An exceptional venue for scholastic use in practice rounds and tournaments.

- A venue for hosting charity tournaments and other fundraising activities.

- A positive use of stormwater retention and city effluent water.

- An office for those retired.

- Effective use of green space.

Considering that it costs $100,000 annually to maintain 150 acres of open park space, the position could be taken that to the extent that the golf course is losing less than $100,000 per year, the continued operation of the facility is economically prudent, presuming that there is not a higher or better use for the land.

THE FINANCIAL GOAL FOR A GOLF COURSE DEFINED

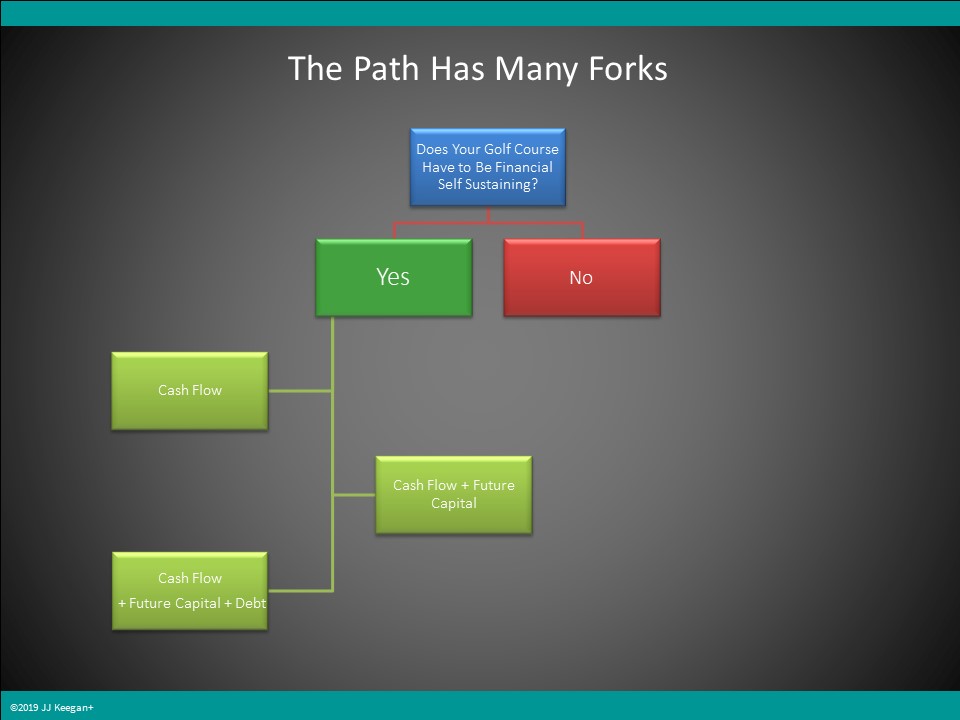

However, that simple calculation overlooks a key benchmark for the financial goal of a golf course. A City Council should quantify the intangible value to its citizens of operating a golf course and set the financial goal for the facility based on the following decision tree:

Most City Councils blindly set the unrealistic goal that a golf course must have cash flow, amortize debt, and create adequate capital reserves for future investment.

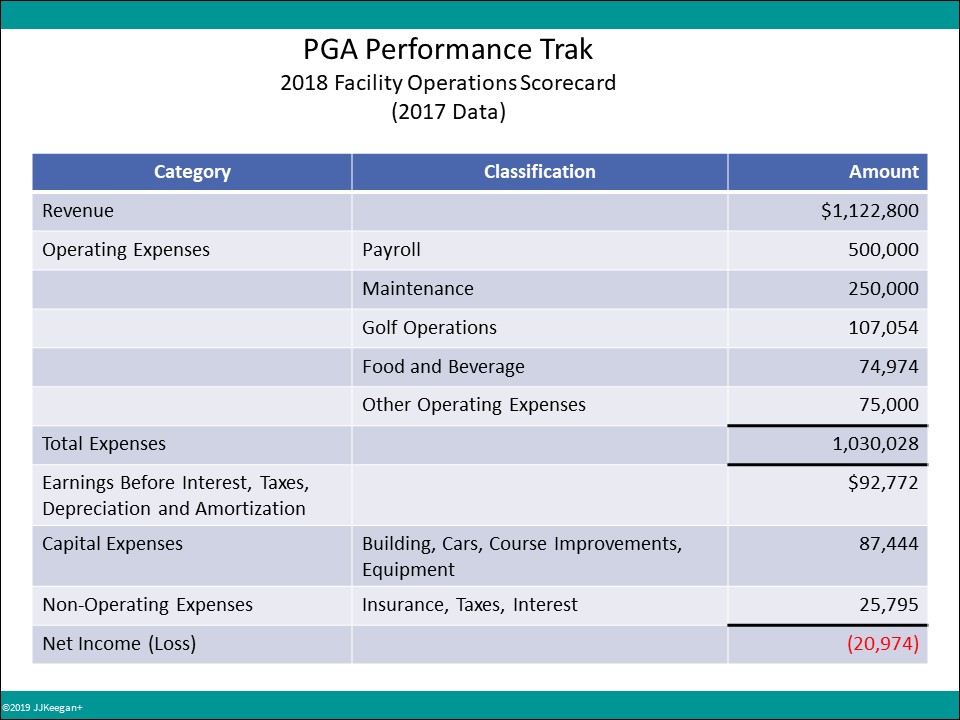

According to PGA PerformanceTrak, the financial performance of municipal golf courses is as follows:

The superficial observer can quickly glean the financial challenge of operating a municipal golf course – there is inadequate cash flow to cover debt and future capital reserves. Hence, most municipalities find themselves behind the eight-ball, having to float a bond for critical capital improvements.

The fact that municipal golf budgets are not established to create capital reserves is the Achilles heel to the long-term financial success of the operation.

THE TWO PRINCIPAL REASONS MUNICIPAL GOLF COURSES STRUGGLE

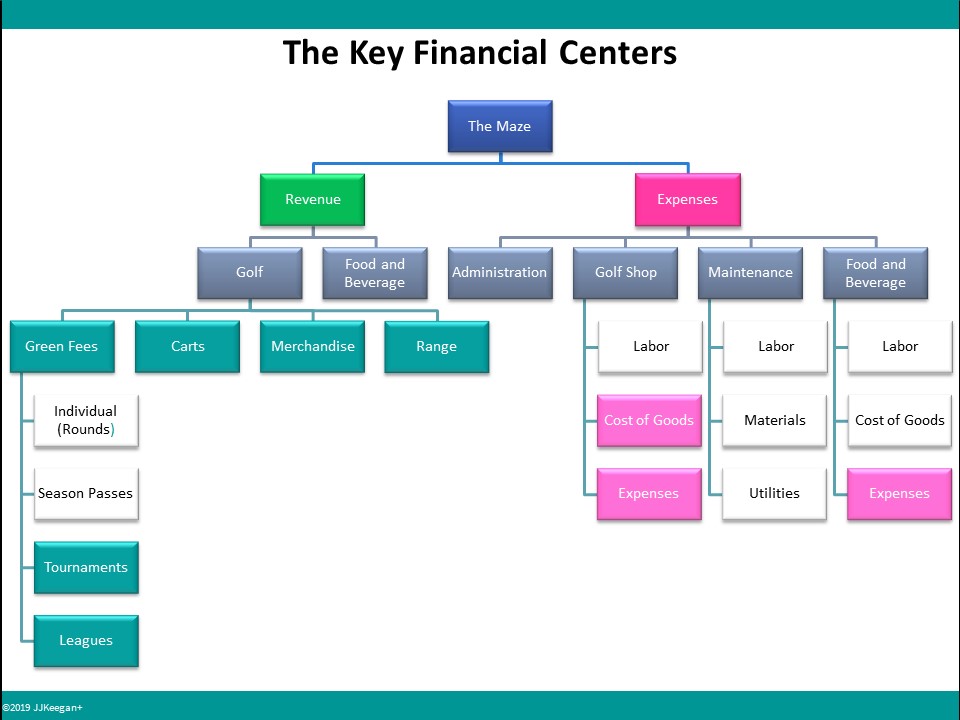

It is our opinion that golf courses overcomplicate the financial analysis of their facilities and often fail to grasp that there are only certain numbers that drive revenue and incur expenses.

The chart below highlights the areas that merit attention.

Carts, merchandise and range revenues are all driven by rounds. The prime-time rate, from which all other rates are determined, and labor, which comprises 54% of total revenues, merit the most attention. The cost of maintaining the golf course, including labor, is typically 45% of total revenue. The cost of fertilizers, water and utilities are outliers in different parts of the country that can cause financial havoc.

Thus, the astute golf course operator needs only to focus closely on rates, which drive rounds, and course conditions, which are largely influenced by labor, but are always the most important factor to a golfer.

RATES

First, the vast majority of municipal golf courses offer rates far below the experience provided.

The best illustration is season passes, which are offered by over 80% of municipal golf courses. They are typically priced at 60% below their fair market value. Note that the rate for a season pass should be determined by presuming a golfer tees off on 32% of the playable golf days, as defined by Weather Trends International, with a 30% discount provided to the rack rate.

The error in issuing season passes is often compounded by municipalities issuing punch passes (pay for 10 rounds, play 12), loyalty cards (offering discounts of 10% to 40% depending upon the initial premium paid) and offering a plethora of over 80 different rates based on the type of golfer (senior, regular, junior), time of the day, day of the week, time of the year.

On an hourly basis, the opportunity to play 18 holes golf may be the least expensive recreational sport in America, if measured in the cost per hour. The median 18-hole fee with a cart in America is $48 or $12 per hour.

Have you been to a rock concert, professional sports or even Top Golf? Recently we paid over $100 per person per hour to attend a rock concert (Goo Goo Dolls and Train), $80 per person per hour to attend the Colorado Rockies vs. the Baltimore Orioles, $50 per person per hour to attend World-Wide Wrestling Federation’s Live Event at the Pepsi Center in Denver, featuring Roman Reigns. Even Top Golf, with my grandkids, averages over $30 per hour per person when food is included.

What is the solution? A golf course is a living organism that requires over $130,000 annually in capital investment, excluding the clubhouse, to sustain.

Municipal golf course rates are like a buoy in the ocean. Rates in the industry for everyone are set by the bottom feeders. To enhance the financial performance of golf course, rates must rise by 40% per hour for a golf course to be economically viable if the goal is to service existing debt and create capital reserves for future investment.

Spare me that golfers can’t afford it. As reported by the National Golf Foundation, “the average golfer is a 46-year-old male with a household income of more than $100,000 who plays approximately 18 rounds per year.”

LABOR

The labor component at a municipal golf course has three aspects that provide unique hurdles that daily fee operators are not challenged with: 1) Retention and termination of personnel, 2) Labor Unions, 3) Fringe Benefits.

The termination of an underperforming employee in a municipal environment is a tedious task that can consume upwards of 18 months, based on the numerous warnings and personnel reviews that are required to be conducted. Save for the illegal use of drugs, theft or misappropriate sexual behavior, employees at municipalities are protected from dismissal.

Second, labor unions serve a vital role in America – in manufacturing concerns that are non-seasonal and provide a stable 40- hour work week. Golf doesn’t meet those criteria. It is highly seasonal and during the peak of the season, 60+ work weeks are common. While municipalities dance around providing “comp” time during off-peak periods, the formula results in excess wages paid.

The third hurdle is fringe benefits. We have observed fringe benefits paid by municipalities range from 35% to 65% of base pay. The fringe benefits of many municipalities exceed 40% of base wages, which is the threshold in which the cycle of death commences. It is noteworthy that the fringe benefit paid by third-party management companies is only at 22%. It is often economical to pay the $75,000 – $100,000 management fee for merely the savings in fringe benefits.

The result is that municipalities frequently understaff to compensate for the inflated wages. The outcome is often an inferior experience for the customer. Whether it be substandard course conditions, grumpy undertrained personnel within the pro shop or a plethora of volunteers who are provided free golf, the consequence is the financial underperformance of the golf course.

SHOULD MUNICIPALITIES BE IN THE GOLF BUSINESS?

Notwithstanding the pitfalls outlined here, the answer is a qualified yes. Within a major metropolitan area where demand exceeds supply, municipal golf courses can thrive. Think Bethpage, Brown Deer, Crandon Park, Fossil Trace or Torrey Pines.

In the hinterlands, the type of golf course experience provided needs to match the altitudinal behavior and demographics of its residents, in which the demand for golf needs to be closely monitored. If the facility is an entry-level golf course that serves as the entry door to the game and is funded gently by the general fund, there is justification for that municipality to be in the golf business. But to attempt to contempt against a daily fee course offering activities that compete against private enterprise, probably not.

However, for all municipalities, there is one clear answer if these entities are to financially survive – rates must go up.

Larry F

To say that municipal golf courses should raise rates is ludicrous. This would be like Sears, who is closing stores, raising prices to bring in more customers. I live in Northern CA and I am retired. During the week I can be at the range at a local course at noon and see nobody teeing off for an hour. While I know that many course uses GofNow and Teeof.com to sell reduced price rounds, I think courses should be more proactive in utilizing real-time pricing to lower fees to increase the number of players during the week, when there is plenty of capacity mid-day. There are too many golf courses in most areas — several have closed in the San Francisco Bay Area in the past 2 years. Until demand increases, golf course operators are in no position to increase prices.

JJ Keegan

The cost to produce a round of golf, especially in California due to water, exceeds the revenue per round generated. Your call – raise the rates or close most courses.

AVT

I had the pleasure of participating in a webinar based consultation with you a few years ago. The four courses under the direction of the City have been a valuable asset and contributor to a healthy seasonal golf environment to the community. One of the four facilities was the first public golf course in the City over 100 years ago. I took junior lessons at a facility that was once considered one of Top 25 Public Golf Courses in the US back in the 80s. When I had an opportunity to continue my golf career with the City, I believed it would lead to a long and rewarding career in the industry. It was clear very early that the failures of the past and present to address the challenges of maintaining, improving and planning for the future success of all four of these facilities. During my time with the City while learning how they “made their sausage”, the most disappointing was discovering that many people in charge of running these facilities are NOT the most qualified. That would include management, City Hall Supervisors and unfortunately some of the turf management specialists. This organization has been poisoned by some of these “professionals” that hold these positions because nepotism, favoritism and a highly discriminatory attitude. Their struggles are directly related to an attitude of “this is how it always has been”, “nothing will change that”. What was even more disappointing was to hear the many individuals throughout the organization, which included private contractors, consistently complain about the deficiencies that exist. The possible solutions would require more accountability, extreme changes (for the better) that would also promote fairness and merit to individuals that deserve it, and a concession by some that they don’t have all the answers. That brings me to understand and appreciate what true leadership means. There are people that have no intention of using resources available to help them learn and grow with this industry, some have actually said it is a waste of time and resources. Municipalities like this one that treat their employees in the way they do and thumb their nose to the industry organizations that exist primarily to help them succeed do not deserve the luxuries and the advantages they provide their golfers and the community. I can appreciate why you believe that Municipal golf has a place in the industry, but industry needs to dismiss any golf facilities that consistently abuse the faith of golfers and the industry organizations that truly care about the game. Maybe my idealistic view of how golf industry professionals should approach their role is perceived as naïve or quite plainly, has no place in this industry. I want to ask you and others this one question, for a game that inspires a great deal of emotion from the golfer (and the golf facility managers use emotion to promote the game), why would it be considered taboo to be very enthusiastically emotional at how we should perform our jobs in golf? My objective during career was to accept my role of providing a service to the golfer, make their experience as enjoyable as it can be, give them reason to NOT complain about course conditions. Without the golfers, that complain or have unrealistic expectations, I and others do not have a job. Lastly, a salute to all those individuals that make up the seasonal semi-skilled labor force that create the course conditions, run the clubhouse and pro shop operations. Without them, the best teachers of the game, the best agronomists don’t exist.