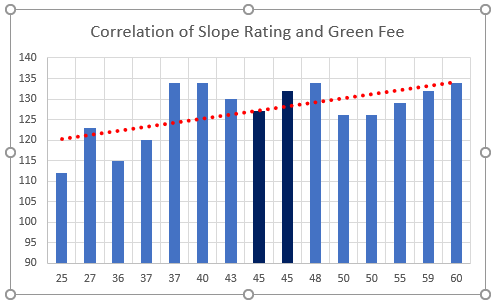

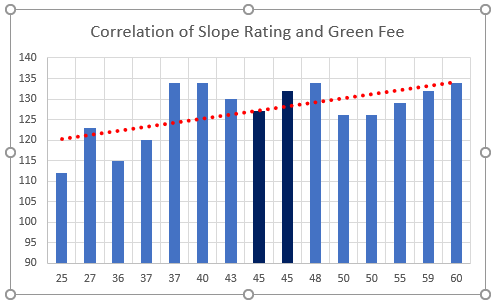

Research in the midwest demonstrates that a correlation exists as highlighted below.

The two darker boxes represent our client’s golf courses.

The two darker boxes represent our client’s golf courses.

If you think about it, a higher slope rated golf course is likely to be longer, have more water hazards, bunkers, trees and more difficult green complexes. Hence, maintenance costs are higher and the need to charge a higher green fee to cover operational costs.

This research evolved from a discussion at a client course losing $200,000 annually. Where their customers more attracted to an easier golf course, albeit 15 miles away, or the lower price they offered? $25 which included cart to play a 112 slope rated golf course in a cornfield in which there were no rules or dress codes or $44.50 to play a championship golf course basked in the historical tradition of the game?

It was is my feeling that the senior golfer seeking an easier golf course and the millennial seeking fun and no rules where principally attracted to the experience – not the price.

That is my opinion. What is yours? Please comment below.

Del Ratcliffe

Hey Jim, you know my thoughts on this and I can’t resist jumping into the discussion! I think that (at least in a sustainable operation) true market-price for a green fee is a combination of many factors, with demand, demographic of the target market and operational strategies of the management team among the most critical. While a higher slope does typically result in higher maintenance expenses, we all know that does not equate automatically to being able to charge more for your golf course. It makes it necessary to GET more (in order to be sustainable) but does not mean the market will bear the price necessary to sustain the operation. Demand is a direct result of the experience provided, and that can and does vary radically from one course to another. The fallacy (IMHO) of using Slope as a significant factor in pricing is that it is NOT a direct indicator of experience – only of difficulty of the course. You can easily have a high slope rated course that is NOT a good design. Conversely, you can have a lower rated course that is a GREAT design, and very popular among golfers, and because of high demand that course can charge more (if management is reactive to the market and prices accordingly). And which set of tees do you base the slope rating valuation? Many courses have a back tee rating that is significantly higher than the more forward tees, yet the vast majority of their play is from the lower rated tees. If the true value were in the higher slope rating, wouldn’t more golfers play from the back? And wouldn’t higher slope rated courses show a definite trend as being more in demand over the long term? As a final point if Slope always equated towards higher value, wouldn’t a high slope rated course always outperform a lower rated course in any given market? I’m good with using slope as a small indicator of value because using “good design that results in great experience” is too subjective. I think you do that very effectively in your pricing formula, but I think it is a big leap to say that slope in and of itself is a predictor of market value of green fees.