With over 9,000 daily fee golf courses and nearly 3,000 municipal golf courses, one would think that there would be generally accepted policies and practices throughout the industry.

Such appears not to be the case based on an industry survey we conducted in February 2021.

Here is where significant disparity exists:

Tee Time Intervals:

Suppose one compares eight vs. 10-minute tee time intervals. In that case, the additional revenue that can be earned from using an eight-minute interval is upwards of $160,000, presuming the courses are operating at only 50% of capacity.

Is 8 minutes the right interval? Not necessarily. The tee time interval should be correlated to the difficulty of the golf course.

Del Ratcliffe, Ratcliffe Golf Services, who oversees four golf for Mecklenburg County, had an interesting observation reviewing the data. Del compared a golf course to traffic patterns within a City and what causes back-ups, i.e., lane closed, rush hour, etc. Del believes that Par 3 holes and par-five holes that can be reached in two shots create bottlenecks on a golf course. Once it occurs, it takes a while for the game to clear. Proper spacing of golfers can avoid these “natural” traffic jams on a golf course.

Thus, Del utilizes differing tee time intervals at each of the courses he manages to ensure players’ optimum flow through the course.

The benefit of an adequately paced golf course is if the play is ordinarily slow with rounds over 4 ½ hours, the course acquires a negative brand image, and demand for that course decreases.

Spring/Fall Rates:

In the survey, seventy percent indicated that Spring rates should not be offered, but it is my observation that most everyone does. Based on the “bear/squirrel” syndrome, I don’t understand why Spring rates are offered. Fall, however, I can appreciate a discount of 10% when aeration occurs, baseball is ending, and college football and pro football are launching.

What is the proper discount if Spring rates are available? The following guideline might provide some insight:

| Discount | Incremental Rounds Required to Generate Same Revenue |

| 10% | 11.11% |

| 20% | 25.00% |

| 30% | 42.86% |

| 40% | 66.67% |

| 50% | 100% |

It is highly unlikely that a facility has sufficient demand to offset a discount greater than 10%.

League Play:

Something seems intuitively wrong that blocking a golf course from 18-hole play in the middle of the day to accommodate 9-hole league play late in the afternoon on the first and tenth tee.

While many courses, particularly North of I-80, generate 25% of annual rounds based on afternoon leagues, the requirement to limit the course to 9-hole play for 2 ½ before leagues start is a concept I understand but can’t financially embrace.

I ran an analysis comparing blocking the course 2 ½ hours for nine-hole to accommodate double tee for league play vs. operating the course “normally.” While the numbers indicate a “tie” between the scheduling alternatives, the assumptions made were biased, supporting double tee or leagues.

At a minimum, I think these leagues and tournaments, and outings should be charged a premium over the rate for the day of the week they are playing. I also believe that outings and tournaments should be charged a premium.

Jeff Hogg, Scott Lake Golf and Practice Centers makes a compelling case to support blocking a golf course for 2 ½ hours to accommodate league play.

He states, “their weakest revenue period is Monday through Thursday until 3 PM. 18-hole fees at $43 with green fees at $27 and cart fees at $16.” What Jeff does wisely is that he charges the leagues a premium for play. Their league green fee is used to establish the rack rate for 9-hole play: $21. That represents 77% of the 18 hole rate compared to the industry benchmark of 60%.

Their league players must pay their entire season’s green fees in advance, with most leagues playing 18 weeks times $21 = $378 per person collected in the last week of April or 1st week of May. Even if the league is short players, they pay for the full complement each week. The leagues play in all kinds of weather, cold, drizzly, and wet conditions.

Finally, Jeff highlights that their league players are our most dependable cart riders, beverage, and range spenders.

Reservation Policies

Nearly 20% of golf courses in the survey indicated that they would not accept walk-up play in 2021, primarily due to their desire to socially distance golfers during the Pandemic. I believe that is an overreaction. While we have seen 2021 cash flow forecasts based on rounds achieved in 2020, we that baseline is a mistake. Most many companies are forecasting 2021 rounds based on an increase of 5% to 10% over 2019. Thus, allowing walk-up play to grab the incremental round may be vital.

2020 demonstrated that golf could be well conducted with social distancing. Hence, walk-up play should be encouraged. I heard of few instances where someone contracted COVID at a golf course.

What we do encourage is the growing popularity of online desktop and mobile app booking. Calling the pro shop is so passe. In a recent survey we conducted, 65% of the golfers indicated they prefer online booking. They averaged 58 years of age with a median household income of $98,0000. Note that millennials (those under 40) are no longer responding meaningfully to desktop surveys.

Considering that most tee time reservations before the Pandemic were made inside a 48-hour window before the day of play, I think seven days for all municipal and most daily fee courses is the right window for booking.

It would be interesting to study the no-show rate based on when the reservation was made. My guess is the further the reservation was made in advance, the higher percentage of no-shows that result.

Annual Season Passes

Annual season passes are an awful concept. Either the course loses when golfers play far beyond the forecast “break-point” or the golfer when they buy the pass and not use it. The season pass “abusers” are wrong customers based on their feeling of entitlement, how they treat other golfers, and often become resented by the staff. The excuse that a golf course needs the “winter” cash flow to tide it over rings hollow to me.

We ran the numbers on offering a loyalty card for $99, $199, or $299 that provides a 10%, 20%, or 30% discount on every round played modeling courses that charged as little as $40 to as high as $75. The loyalty card program far outperformed a season pass in increasing the revenue per round regardless of the number of rounds played. Call me (303 5966 4015) if you want me to run the comparison for your course.

In 2020, golf courses that offered unlimited season pass underperformed their competitors who didn’t. We summarily reject the arguments that golf courses need to sell these passes to provide cash flow during the off-season.

Employee Play

Prior to the Pandemic, I ponder whether providing weekend access to these groups, particularly the active-duty military, at a 10% discount would have been viable.

We just completed an engagement where full-time employees, part-time employees, and volunteers are precluded from playing the golf courses at which they work. I don’t understand that. If I owned a golf course, it would be a requirement that the golf staff and the agronomic crew play golf bi-weekly so each could understand the experience being offered to the customer working in tandem to improve the playing conditions.

There is a significant catch on allowing Volunteers to play golf for free. The IRS considers it compensation at a daily fee owned golf course. If one googles “Volunteers and Golf,” several articles appear where the owner was required to pay the IRS over $80,000 in back taxes for volunteer play. Interestingly, non-profits, i.e., municipal golf courses, are exempt from this requirement.

Conclusion

The lack of a standard set of generally accepted business principles for the golf industry is its Achilles heel. Click here to download the full survey results: Download.

What does the future hold for golf?

A golf course’s success depends upon its location, the weather, agronomic practices, operations, the customer experience, financial benchmarking, and the proper adoption of technology to facilitate the creation of a customer database for marketing. The simple goal is to create a valued customer experience on a foundation that generates sufficient cash flow to provide the desired return.

Most don’t realize that a golf course is a living organism that is continually changing, requiring continual investment. Thus, understanding the current customer preferences and their historical spending in combination with the amount of deferred capital is vital to determine the facility’s fair market value.

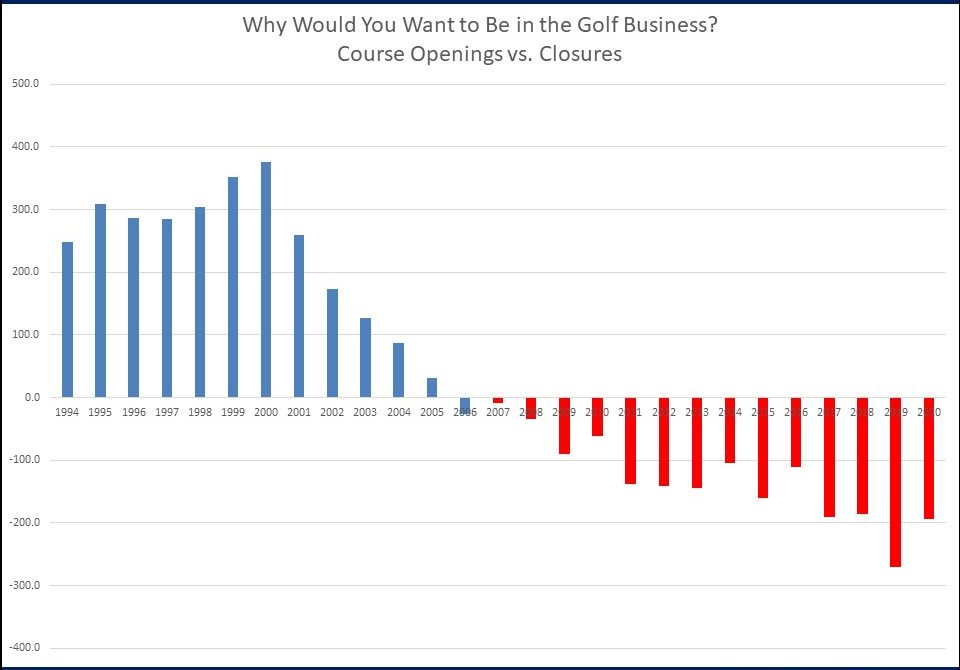

The Covid-10 Pandemic, notwithstanding 195 golf courses closed in 2020, has slightly abated course closure trends as reflected below:

With rounds up 13.6% in 2020, it provided revenue increases for nearly all facilities that provided short-term cash relief. Will 2021 match 2020?

Most management companies have budgeted revenue increases from 5% to 10% from 2019 – not the 2020 numbers achieved. There are many caveats that make 2021 a wild card. Here is a list of the “ifs” for 2021:

- Health County COVID-19 policies

- The ability to attend sporting events remains muted,

- Restaurant indoor dining remains capacity restricted.

- Movie theaters remain at reduced capacity.

- Normal to favorable weather patterns

- Leagues, outings, and tournaments are the activities permitted with groups of 100 under less restricted conditions.

Thus, for golf courses that are poorly managed, were teetering on closing before the Pandemic, and whose facilities are located in heavily populated metropolitan or suburban areas, the surge in real estate home building will result in many tempting offers to sell. Several years ago, Walter Lankau, the former owner of Stow Acres, when asked what he sees when he gazes out from the clubhouse to the golf course, stated, “A future real estate development.”

In 2015, the National Golf Foundation forecast that with a 1% annual increase in rounds, demand and supply would reach equilibrium by 2022, presuming 150 golf courses closed annually. With no increase in rounds growth, the NGF project equilibrium would be reached after 2026.

The ownership of a golf course, at best, is a small business, subject to many perils. Thus, the continued closure of golf courses is highly likely for those who don’t implement sound and consistent business principles.