When operating in an alliance in which the financial interest of different owners have a vested stake, the loyalty programs are based on a simple assumption.

The redemption of rewards earned by consumers will be evenly distributed amongst all owners on an equitable basis. Do you think the hypothesis is true?

It would be patently unfair if an owner of an airline, hotel, restaurant or golf course were to unduly bear the burden of providing free services disproportionate to the revenue they earned from those and other consumers while they were earning points. Conversely, it would be just as inequitable for an entity to generate substantial revenue in which loyalty points are earned and then severely restrict the redemption of the points at their facility.

For example, if a customer earned their loyalty points at a franchised Fairfield Inn but redeemed their points at another franchise, i.e., J.W. Marriott, would that be equitable to the owner of the J.W. Marriott? If I were to earn points at the Ridge at Castle Pines owned by Se Ri Park but redeemed the reward at a Troon managed Scottsdale course, would that be appropriate? Or, if I earned points at the Courtyard at Sienna bar but redeemed them at the Denver’s best steakhouse, would Shanahan’s be treated justly?

Our research has revealed that not all managers of loyalty programs play the game fairly.

United Airlines is among the worst, and there is a valuable lesson for golf course owners that are managed by a third party.

Let’s first examine examples of how the inequities arise focusing on the airline industry.

Airline tickets can be purchased on United 335 days in advance of the day of travel. When seats become available, United will offer saver award and everyday awards for redemption on other carriers but will offer NO SEATS to fly on their airline.

Here are three recent examples of how United Airlines is unethically playing the game in my opinion:

• On October 28, 2016, after several months of searching for a business saver award ticket for my wife to fly on February 28, 2017, from Denver to Johannesburg and on March 17, 2017, from Capetown to Denver, I was able to obtain business class seats on Swiss Air and Ethiopian Airlines. The connecting flights from Denver to Chicago (UA457) and Los Angeles to Denver (UA314) on United were waitlisted with the only coach being available. Though first-class seats were available on both the UAL legs the day of the actual flight, we were not cleared for the upgrade on either though points were redeemed at a business class tariff.

• From March 31 through July 7, 2017, I searched daily for a SAVER award on United for my wife from Denver (DEN) to Kahului (OGG) for a departure around February 28, 2018, with a return around March 13, 2018. Nada, Zilch, Nil, Zero, Diddly Squat. Finally, in frustration, I purchased on July 7, 2017, for $3,852 business/first class tickets only with great chagrin to learn that fourteen days prior to departure, United offered numerous SAVER award seats to Kahului on flights that would have been acceptable. One first class seat was even available for a complimentary upgrade on the day of each flight.

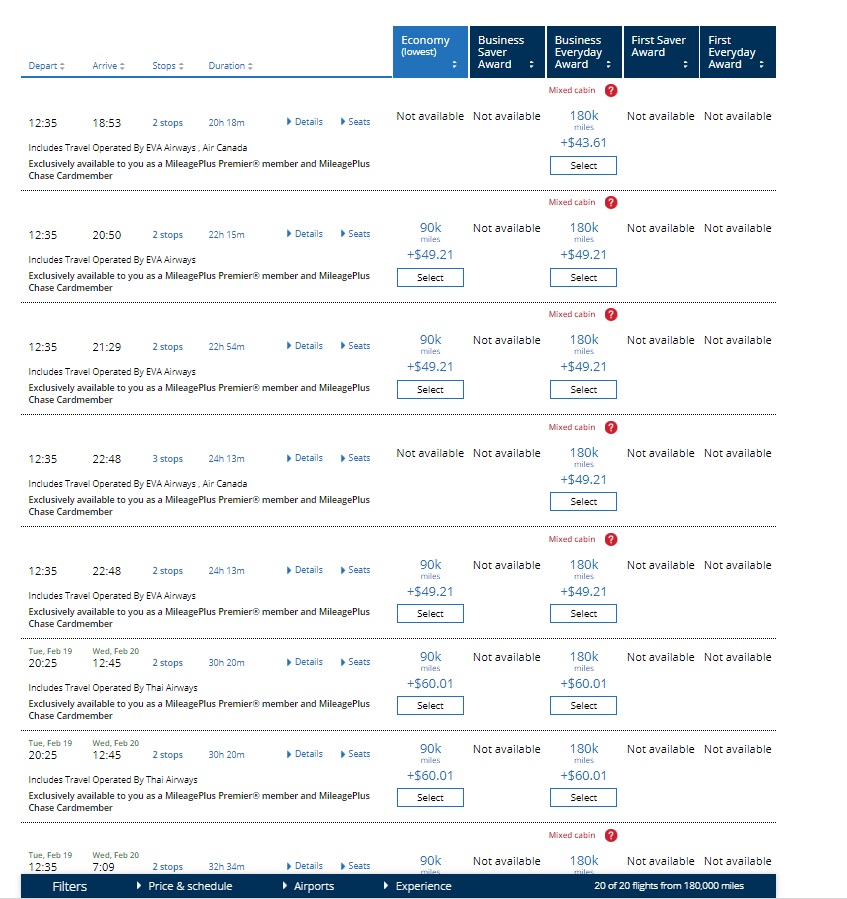

• We are seeking to fly from Denver to arrive in Bangkok (BKK) on February 4, 2019, via Hong Kong (HKG) departing on February 19, 2019, from Nội Bài International Airport in Vietnam (HAN) returning to Denver. We are hoping to take another fabulous Perry Golf Trip. Award seats are only available on Air Canada, EVA, or Thai International as illustrated below. You can’t even redeem an “EVERYDAY AWARD” on any trans-pacific United flight to Beijing, Hong Kong, Narita, Seoul or Taipei. We have searched daily for the past month and found nothing. Is United playiing fair in only allowing rewards to be redeemed on partner airlines? I don’t think so. #UNITED #UAL

Since the merger with Continental and the issuance of points for credit cards, the redemption of points for upgraded travel has become a real challenge.

What is the solution and the implications for a golf course owner?

First, it is important to realize that all loyalty programs are disguised discount programs.

As an accountant, I view that debits should equal credits. The designation of points by the source of original vendor, while an accounting nightmare, is perhaps the only equitable method. If I earn points paying patronage to one vendor, I should be able to redeem those points with that vendor more easily and for greater value. All things should in balance.

Points earned should be based on dollars spent not miles flown, hotel nights stayed, number of rounds played or restaurants visited. For each dollar spent, it would generate a redemption value, i.e. 5%. Thus, if spent $1,000 on green fees, it would entitle me to a $50 credit for a future round. Obviously, the actual cost of the round would vary based on time of day, the day of the week and time of the year.

If I have earned the reward, I should be able to redeem not subject to further yield management pricing controls, i.e., black-out periods or the restricted release of availability.

That is what I think? More importantly, what do you think? Comment below.