Municipal golf courses are the entry door to the game. With the burgeoning participation of youth via Drive Chip Putt, Girls Golf, Golf-In-Schools Program, PGA Junior League and The First Tee, one might be bullish on the over 2,000 municipal golf facilities being able to help grow the game.

I am not.

The organizational structure and culture that pervades the vast majority (but not all) of municipal golf ranges from negligent to mediocre. From inept accounting practices where cash flow statements provide little clarity, to Purchasing Department bureaucracy, to labor benefits exceeding 40% of base pay, to excessive common service allocation fees charged to the Golf Enterprise Fund, to antiquated hiring/dismissal practices, to politics where fiscally attuned City Managers battle City Council members seeking reelection by placating the proletariat, and to well-to-do citizens demanding that low-priced golf via highly discounted season passes is their right, municipal golf is a great example of waste, inefficiency and fraud.

Here are some examples we observed just in February, 2017.

A Collier County, FL Purchasing Specialist writes, “Thank you for your interest in project 17-7086 Golf Course Analysis for Collier County. My original quote platform was flawed as I did not request references to determine the responsibility of the firms that submitted. I re-posted the quote under 17-7086R.

Collier County subsequently rejects 5 of the 6 bids submitted on technicalities, including that of the National Golf Foundation, accepting a sole bid that was 100% higher from, in our opinion, the least qualified firm. Some were rejected because they were “digitally signed” and deemed not to be a legal instrument though such is recognized as valid by the courts.

A five course municipality, received a comprehensive strategic plan from the National Golf Foundation dated December, 2013, implements none of the recommendations, and issues another RFP in November 2016 for consulting services because $50,000 was budgeted on a spend or lose basis and selects the least qualified firm. They are skilled at landscape architecture and urban design but it is my opinion that they know little about golf operations at the level of sophistication necessary to create value. I do concede that the firm is smarter than the client they are guiding. Note that we did not bid recognizing the folly of their practices and that the exercise would be a wasted effort. We only accept engagements where we can make a positive difference.

The General Fund of a four course municipality charges Golf’s Enterprise Fund $1,053,250 annually in general and golf administrative fees to oversee those courses that gross $5.3 million in 211 playable golf days. Yet, they cannot find the money for desperately needed for capital investment resulting in a quickly deteriorating customer experience.

A County Water Department charges a City 27-hole and 9-hole golf course $589,000 and $229,000, respectively ($889 per acre feet) for non-potable water. The General Fund has had to transfer $2.5 million in three years to keep the Golf Enterprise Fund aloft. The 2017 budget calls for an additional transfer of $1 million.

The benefits paid for three cities we reviewed were 39.2%, 47.1% and 54.2% of base pay. The labor burden makes these courses financially unsustainable without General Fund transfers.

I ponder if the most egregious error a municipality makes is the organizational structure adopted in which concessionaires are retained to operate the pro shop. The City receives the green fee revenue but is responsible for all maintenance and capital improvements. The concessionaires are entitled to all cart, range, merchandise and food and beverage revenue paying only a small percentage of income to the City. The City gives away the lucrative profit centers and accepts the responsibility for the highest financial burden. In the three multi-course municipalities we examined in February, all had two things in common – massive operational losses and deferred capital investment exceeding $15 million.

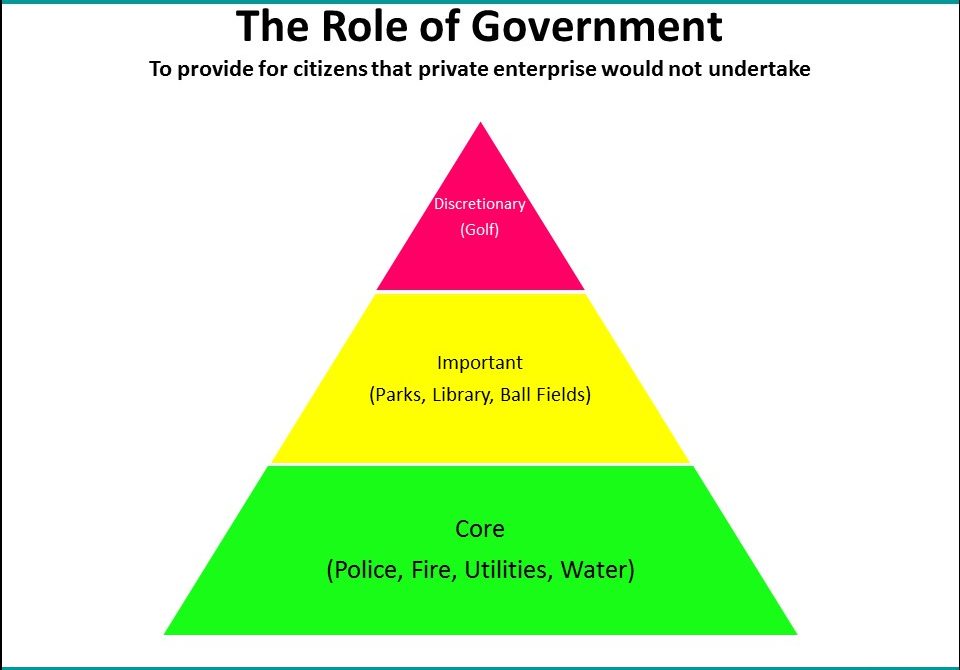

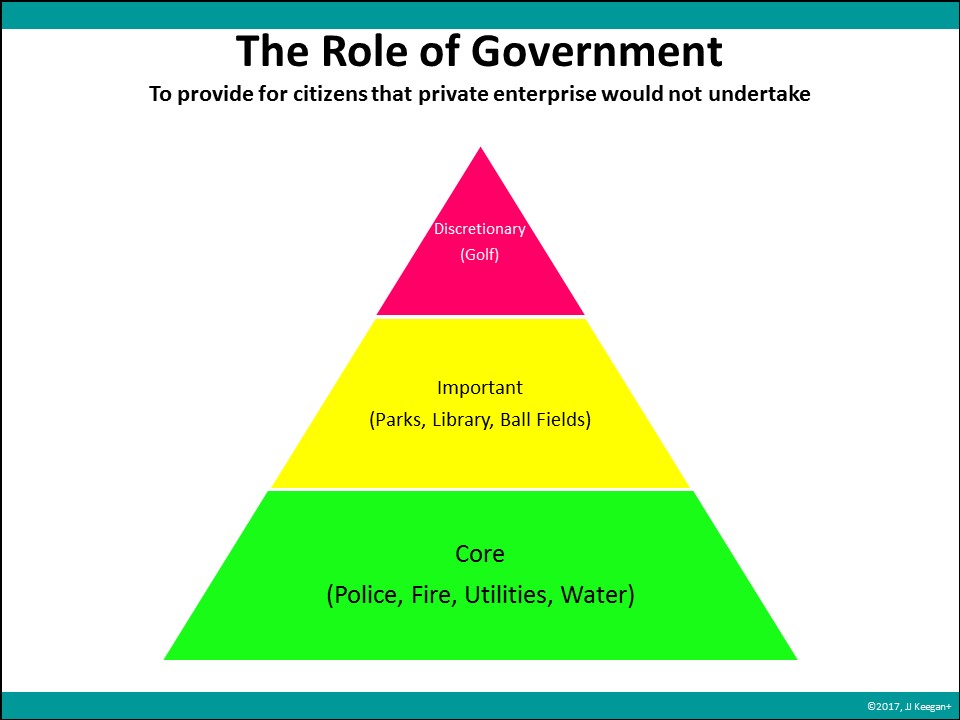

That begs the question, should municipal golf course be in the business of golf? The fundamental role of government is to provide for citizens that which private enterprise would not undertake. Core services, as shown below, are police, fire, utilities and water. It is understandable that parks, library and ball fields be funded. But golf?

All of this is tragic. Municipal golf courses, if properly managed, should thrive. They are located in urban centers where the demand for golf vastly exceeds the supply. The threat of new competition is nill.

Municipal golf courses are calling out for professional management. That is what I think. What is your opinion? Comment below.

Mike Kahn, Golfmak, Inc.

JJ,

Excellent article. I shred RFPs.

However, a recent muni job was for Village Links of Glen Ellyn near Chicago. Without need for the RFP process, we were hired and paid from their discretionary funds. Associate, Bill McIntosh partnered with me in that gig.

Village Links is one of the busiest, most prosperous golf courses in the country. They have several teaching professionals working with groups of people taking up the game. Therefore, they contribute to the golf business health of the area by starting hundreds of new golfers every year.

If you get a chance, interview the Glen Ellen City Manager, or Assistant City Manager. You’ll hear the 27-hole golf course has never dipped into public funds (taxpayer money) in its history.

Every muni in the country needs to look at Village Links (http://villagelinksgolf.com/).

You’re right about 95% of municipally owned golf courses.

Mike

Paul C.

JJ. Even with the challenges of operating within the “Government Bureaucracy” some operators find a way to cover their expenses and fund a healthy capital repair, replacement and improvement program. Working in municipal golf operations for over twenty-five years I have seen a lot of different methods for operating with pro’s and con’s in all areas. Blake is correct that the recipe for success is for municipalities to empower their golf operators so they can be progressive, however, hiring the right people in the right places is the key ingredient and the importance of the 4 P’s cannot be overstated. There are successes and failures in all methods of operating. For example, Jim’s suggestion below seems to be what Martin County had done for many years. The County recently took their course back because it was failing. Our blend of County operations and contracted services works for us. It is not perfect and at times not pretty but we get the job done without ad valorem tax support. When we got into golf access was limited and golf was too expensive for many of our residents. We see ourselves as the gateway to golf and the provider of affordable golf in our County. Junior golf gets a high priority in our operations and it is evident in the numbers of participants that progress through our system. I don’t think you would find many private operators that would give up an entire Saturdays business several times during the year to host junior golf events. We do and we believe it is our responsibility to do it. As an aside to Jon, no funds from the recently approved Palm Beach County sales tax referendum can go to County golf operations.

Kevin Coombs

One comment regarding concessionaires. While they do get control over operational income with low COGS – carts, range, beer – they don’t have control over the product that most directly affects their customer traffic: the golf course. Municipalities with control over maintenance practices can and have made decisions for major turf projects that impact course quality and lower round counts and customers for the concessionaire. And the concessionaire is powerless.

Jim Roschek

I think Municipalities must realize that they are not proficient in operating golf courses but also realize that privatization is not the answer either. A public/private partnership where the City maintains control but is not encumbered by purchasing, benefits and hiring issues can work in this environment.

The model works in the following way: The City Council creates a mechanism that separates the control of the golf courses from the Parks Department to a group of interested citizens/golfers. The association that is created operates the day to day operations of the golf course. In an ideal situation, the new association has its own checkbook and operational revenues fund the operations. This group picks its own leadership and hires the golf personnel to run the golf operations. The members of the Board of Directors are elected from the golfing population.

o Advantages of the Hybrid Model

> City maintains control over its facility

> Operations are not encumbered by City rules and regulations

> Purchasing

> Employee benefits

> Hiring issues

o Hybrid organizations can still benefit from its relationship with the City

> Borrowing money

o Operating income stays at the golf facility

Jon C

Here in Palm Beach County we just increased sales taxes from 6% to 7%. Even though to some voters this was seen as a minor “1%” increase, it is in fact about 16% in one simple vote and it will be long-term. So that type of tax could potentially support cost increases at muni golf courses in this and other municipalities, however a 16% increase can get spoken for pretty quickly.

CP

Love the article. What is funny is that most municipal entities will hire a parks and rec manager to oversee a golf operation. Usually, that person has zero experience in golf operations, let alone running a business. The golf product almost always suffers.

There is a place for municipal golf, but not at the expense of the taxpayer.

Blake

JJ,

The culture and organizational structure is by far the most important factor in this equation IMO. When municipal leaders take an autocratic approach to their golf courses, they are destined to fail and waste taxpayer money (general fund) to stay afloat, seen that firsthand. When they are progressive and empower their golf operators to make the decisions pertinent to staying competitive, they can thrive. Enterprise fund status leaves the operators subject to bureacratic municipal policies and pay/benefits without the same access to resources as those operating in the General Fund. This and the deferral of capital investment degrades the culture at these facilities and “good enough” becomes the mantra. A city manger or council that values golf have the most immediate effect on the priority given to golf. Core services surveys like you mentioned doesn’t equate to closing down golf courses, rather a decrease in operating budgets followed by a decline in quality. IMO, municipal golf has it’s place as an entry point for old and new golfers alike. The culture within dictates whether they thrive or just get by.

Harris D.

I agree with you on many points in your article. However, I disagree with your professional management group approach to running municipalities as they too have unnecessary levels of managers and, in most instances, obsess on the bottom line numbers at the expense of your aforementioned growth of the game endeavors so badly needed in the golf industry today.

Matt Just

Great writing style! Hard to refute the article…But I can’t wait to be a future case study in perseverance and new best practices.

Mike Kahn

JJ, You are on the money with that story – although, a few typos. There is a model, Village Links of Glen Ellyn, just outside Chicago. Probably one of the busiest munis in the country. 27-holes and over $5 M in sales. They’ve never dipped into public funds. You are right about 80% of them. I’ve been watching them for 60-years.

My shredder eats up muni RFPs regularly.

Mike

Andrew Wood

Spot on again bottom line is they should NOT be in the golf business in most places!