We reviewed during November 2018 32 financial statements of golf courses operated by seven management companies. Do you think that there was any conformity in how they presented the information? There wasn’t.

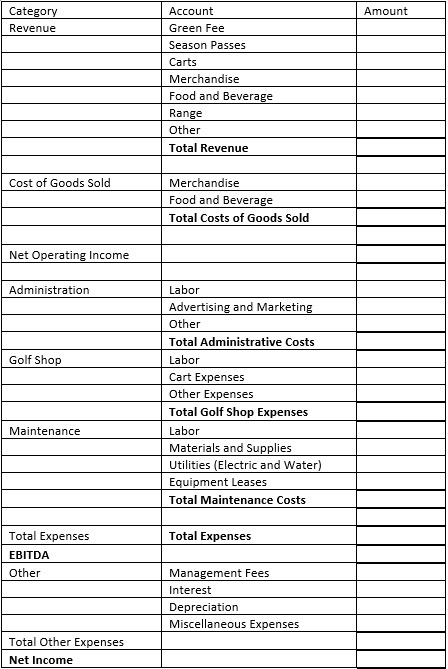

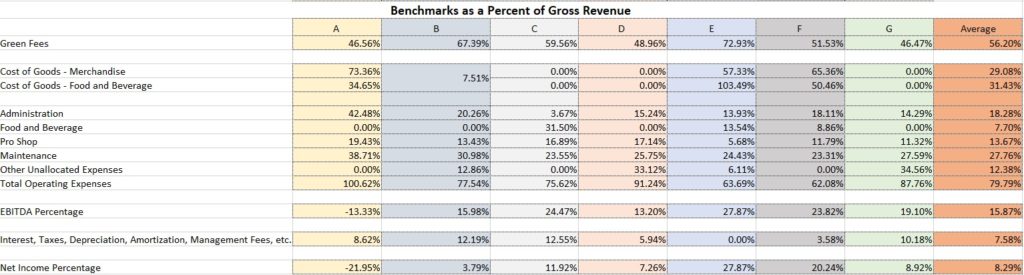

The exercise was straightforward. Provide examples of your successful management of a golf course using the following template:

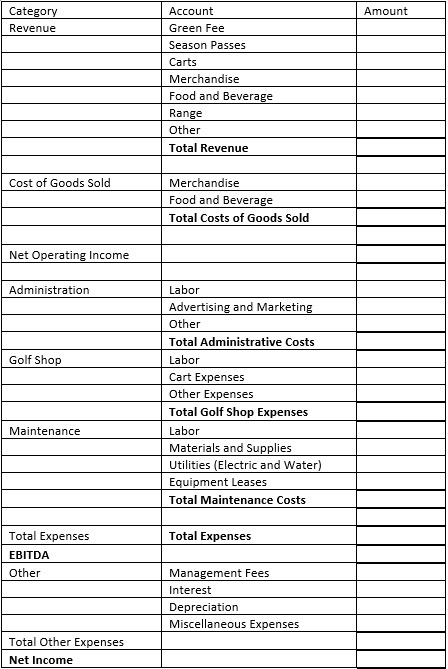

This simplified template provides a golf course owner the ability to analyze the financial performance of their facility quickly. Presented below are the composite averages for what was received from the management companies that we have randomly labeled A – G:

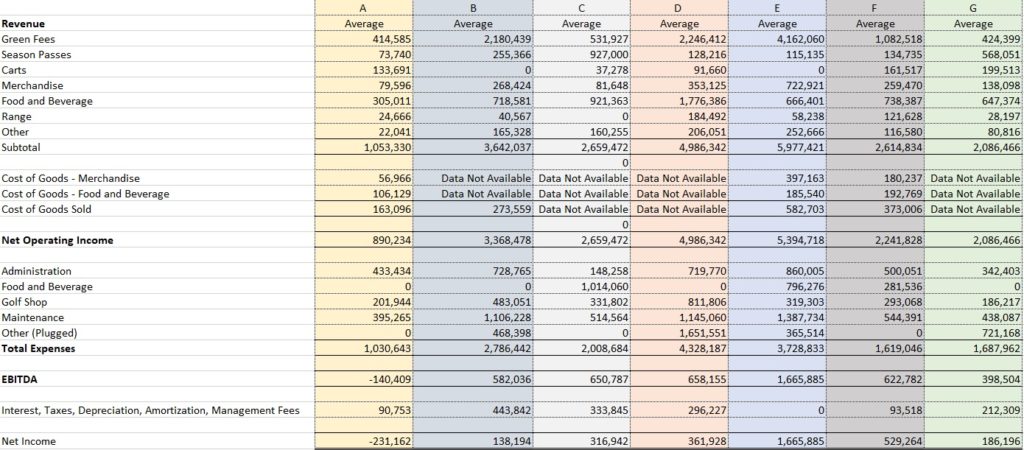

There are certain numbers that standout, i.e., the wide disparity in net income, cost of goods was not tracked as a separate line item by some, and the need to “plug” other expenses – in some cases over 30% of total costs. What was very insightful was a comparative analysis of various benchmarks shown below:

What is the lesson for you? The financial performance of golf courses varies widely even amongst the most talented and professional course operators. However, there are some general rules of thumb.

We believe that the income statement for a golf course should be organized by the department. Labor expenses comprise about 54% of a golf course total expense. Too often we see where all payroll is consolidated into a single omnibus account rendering comparison to industry benchmarks published by in PGA Performance and the GCSAA challenging. Fringe benefits should be separate line items rather than aggregated with salary. If fringe benefits exceed 40%, the prospects for the successful operation of a golf course are dimmed.

Green fee RevPAR should be 60% of the highest posted rack rate. Merchandise cost of goods sold at 70% and food and beverage expenses at 40% are benchmarks to monitor. EBITDA should approximate 20% of gross revenue. Capital reserves around 8% of gross revenue.

Maintenance expenses can vary widely between $400,000 to over $2 million but should average 45% of gross revenue. Note the average maintenance expense for a public course is $550,000 while the maintenance expenses for private clubs is typically near $960,000.

Another benchmark is the cost of water. If it exceeds $80,000 per year ($1.20 per 1,000 gallons or $387 per acre-foot), achieving sufficient cash flow to fund future capital expenditures will be difficult.

For the typical public golf course that grosses $1.4 million, administrative costs of $200,000, food and beverage expenses of $100,000, pro shop expenses of $300,000 and maintenance costs of $550,000 could be anticipated.

While not hard rules of thumb, these strategic guidelines provide early warnings markers where further investigation may be warranted to ensure that your golf course reaches its investment potential.[/vc_column_text][/vc_column][/vc_row]

Michael A Kahn

Well, well, well. An issue I’ve complained about for fifty years. There’s no continuity when it comes to financial statements and P&Ls in the golf course business. How the hell can anyone really know what’s going on at their golf course business if the can’t even find out what it cost (and margin) to serve a ham sandwich?

I’m not an accountant but I’ve had to show accountants how to categorize golf course divisions a hundred times. I’ve reviewed management company statements and found many of them at least confusing.

When I ask for financial statements for my reviews I want them in Excel so I can rearrange them into proper categories so I can see a clear picture of the business.

Like I’ve said, “Dumbest of all industries!”

Mike Kahn, Golfmak, Inc. Over 60-years in the golf course business.