Barter is an intransitive verb and is defined, “to trade by exchanging one commodity for another.” What is wrong with that? Nothing on the surface. But in the golf industry, the word “barter” has taken on an extremely negative connotation.

The Pandemic provides golf course owners a unique opportunity, with demand exceeding supply, to review their marketing strategies and see if this is the opportune time to end their use of barter in exchange for golf management software.

GolfNow (Golf Channel), Supreme Golf, TeeOff.com (formerly PGA Tour/EZ Links and currently Golf Channel), Groupon, and Golfzing (American Golf Corporation) are often labeled as bandits by course owners for lowering prices, providing inferior software, employing inappropriate marketing tactics and operating on an unequal playing field through near-like monopoly power. Is the criticism fair?

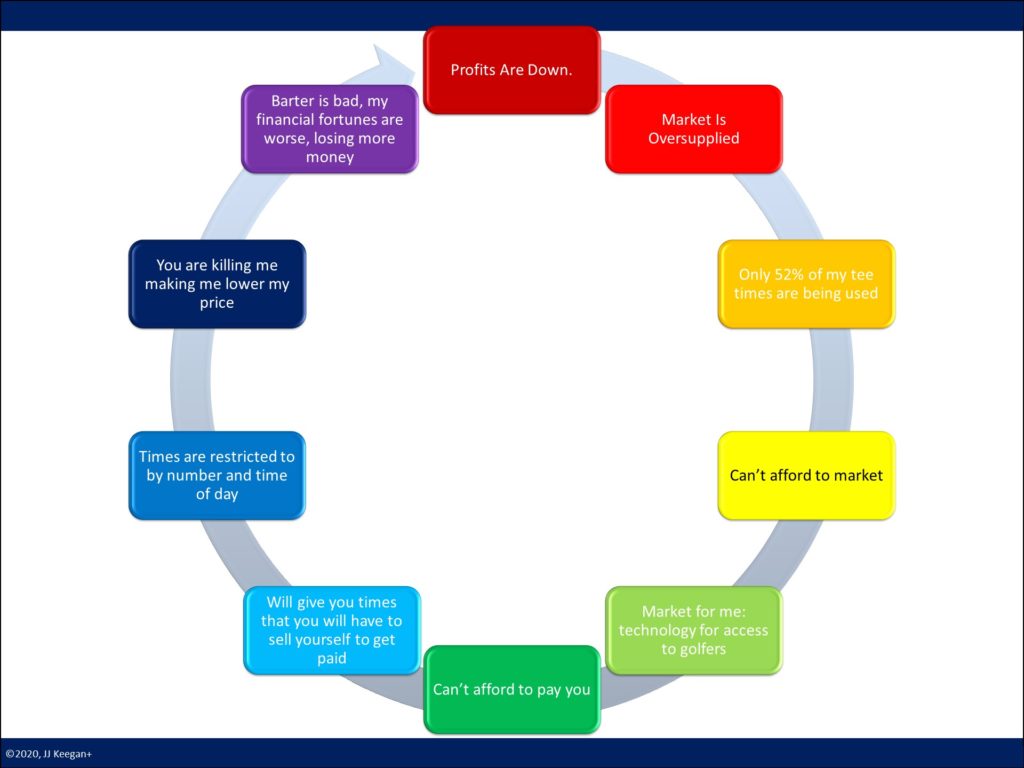

Most golf course operators express the frustration based on the following historically dynamics:

There is a Japanese expression, “The other side of a coin has another side.”

Barter at golf courses predates these tee time providers by decades. Golf courses have provided complimentary access to newspapers or golf magazines in exchange for advertising. Golf management has exchanged professional services, i.e., accountants or lawyers, for free or at a discount. Thus, to say barter is bad, superficially, is incorrect.

It is first necessary to give credit to what third parties do well — the good we can celebrate. We live in a capitalistic system in which private owners control a country’s a trade and industry for profit, rather than for the State. Should we congratulate these third-party vendors for their success as capitalists? Maybe, except they’ve done so at the expense of their suppliers — golf courses.

Second, they are excellent marketers. Their very smooth and polished salespeople give you high confidence and assurance in their statements. They have created a vast marketplace in which millions flock for discounted golf. Currently, as a result, it is nearly imperative for a golf course owner to participate or be severely disadvantaged.

The leader in this industry by a wide margin is GolfNow, with tee time distribution on more than 9,000 courses worldwide. Unfortunately, in a research program undertaken by the National Golf Foundation to gain a comprehensive understanding of tee time distributors and golf management systems, GolfNow’s net promoter score was a -26, and they were rated lowest on nearly every benchmark measured.

Notwithstanding that rating, the potpourri of products they offer is impressive.

What most fail to grasp is that the third-party vendor’s customer is the golfer — it is not you — the golf course owner. There is nothing inherently wrong with the mission statement of seeking to serve the golfer exclusively. And if access to that customer is through a golf course owner, to the extent that the financial arrangement is mutually beneficial, the concept of barter is valid.

However, it is their internal belief, shared with me by GolfNow’s senior executives, that the NGF, PGA of America, PGA Tour, and USGA are not principally focused on ensuring the financial stability of the golf course owner. Instead, their focus is growing their Associations with little sincere concern for increasing the number of golfers.

That opinion is not without substance. In speaking with a PGA Tour representative when they were beginning to research how they might enter the tee time business five years ago, their focus was jealousy of the revenues earned by GolfNow. He felt that those revenues should be collected and accrue to the benefit of the PGA Tour. Nowhere in the conversation did he mention a concern for the golf course owner.

The flaw in the barter arrangement with third-party tee time vendors is that the golf course owners have lost control of the price at which their inventory is liquidated. Thus, all third parties, as well as Golf Associations, should be approached with caution.

Here are some suggestions.

Suggestion 1: For the golf courses in your competitive marketplace, band together and either drop off of third-party vendors totally or collectively demand floor pricing at 25% of the retail rate for the tee times sold. Even go it alone if you must.

A California multi-course operation elected several years ago to discontinue using the third-party vendor who dominated in that market, as they were unable to agree to a “floor price” for the sale of their trade times. The short-term impact over the next couple of months was that rounds fell across those courses. However, rounds returned to average daily volume after 90 days, and revenue began to rise. There is a lesson there.

Suggestion 2: Be mindful of the cancellation clause in your agreement. Third-party vendors typically have a 90-day cancellation clause that we understand has been stringently enforced. When not providing sufficient notice, the contract auto-renews for another year. We heard of one course in North Carolina that only provided a 30-day notice and was required to continue the service for another year.

Suggestion 3: Audit the “fences,” i.e., the tee time before twilight, created by third-party vendors for the sale of barter times to ensure they comply with the contract. We know of several examples where the fences were violated. To the credit of the vendors, they refunded to the golf course revenue generated from tee times sold when the discrepancies were cited. More often than not, “honest mistakes from new employees” were cited, and compensation was not made.

Suggestion 4: Test their Ethics and Integrity. Create a unique email address that you enter into your POS database. Monitor if you start receiving an email from the third-party vendors where they have taken your intellectual property for marketing their barter times. I wouldn’t be surprised if they are using your proprietary customer names for their benefit. Catching them would be somewhat hard to spot unless you set up some unique emails used exclusively for this test.

Suggestion 5: Follow the lead of some golf courses operated by management companies and schedule tournaments and outings during the trade times. While third-party vendors may want alternative tee times, there is nothing in most of their contracts, according to what we have heard, that precludes this practice.

Suggestion 6: Create an SKU in your POS system that tracks the date and time of 100% of the barter times sold. Calculate the value of the liquidated trade and compare it to the quality of the software received, asking yourself, “Am I getting value?” If not, for $12,000, there are fabulous integrated solution solutions available where you could create your own database and market to it proactively.

Suggestion 7: You need to thoroughly understand what is in it for your course. You could select Club Caddie, Club Prophet, Lightspeed, ForeUp, or Teesnap for less than $10,000 and acquire a fabulous integrated software solution and build your database to market it proactively.

Suggestion 8: Read the contract carefully and thoroughly understand the provisions of the agreement and all of the associated boilerplate.

These simple suggestions are not to be considered as comprehensive solutions to deal with third-party vendors. In January 2020, the National Golf Course Owner’s Association (NGCOA) issued an extensive and foreboding 62-page report regarding the perils of barter. (Click here). The report is thorough, detailed, engaging, and timely, with the merger of GolfNow and EZLinks/TeeOff. Lead researcher and author Harvey Silverman, a longtime golf industry marketing consultant, and observer, compiles case studies, academic reports, and findings from across the Internet’s golf landscape. Silverman makes a strong case that it’s not just about the barter math, but also the collateral damage caused by giving up tee times to online tee time agencies (OTTAs).

From the report:

- “OTTAs have created a highly competitive landscape to gain customers. They enhance their offerings to golfers beyond ‘hot deals’ or the like, offering flash discounts, loyalty clubs, free passes, and subscription services. The result is that OTTAs routinely circumnavigate even the lowest agreed-upon resale price of tee times with golf course operators and can cause confusion for the golfing customers.”

- “OTTA sites such as GolfNow, TeeOff, Golf18 Network, Last Minute Tee Times, and others have trained millions of golfers to shop for a price first. With that, golfers have gained a reference-price-effect perspective that golf is too expensive. Golf course operators need to consider whether a third party should be allowed to have this much influence over their pricing and overall product image.”

- Drs. Cathy Enz and Linda Canina of the School of Hotel Administration at Cornell University added, “Demand for golf is primarily inelastic, suggesting that a price drop will not have a significant impact on demand and thus, revenue will decrease.”

- And lastly, Silverman states, “To put it simply, paying with cash instead of tee times eliminates nearly every issue associated with bartering tee times.”

Is the Industry Benefiting from Barter?

Golf hit its apex in the early 2000s with more than 30 million golfers enjoying the over 16,000 golf courses, playing 518.4 million rounds, according to the National Golf Foundation. Prior to the Pandemic, the number of golfers had fallen to less than 24 million, and we have witnessed 14 consecutive years of more courses closing than opening, leaving less than 14,500 facilities. With 2020 rounds again exceeding 500 million and rounds, through August 2021, up 11% over 2020, this is an excellent opportunity to ask, “Do I need barter?

If third parties were good for the golf industry, rounds and revenue would have increased. In the process, third parties have earned an estimated $150 million annually with accumulated earnings, probably approaching $2 billion in a segment of an industry that generates only $21 billion in revenue annually.

Thus, each golf course may have been financially disadvantaged, perhaps by $200,000 or more.

Author: JJ Keegan, Envisioning Strategist and Reality Mentor. Click here

© 2021, JJKeegan+