Leisure Investment Properties Group

2020 Golf & Resort Investment Report

Q&A with JJ Keegan, Envisioning Strategist and Reality Mentor

- How do you see the future for various types of golf properties during the next five to ten years?

- Private

- Daily Fee

- Municipal

If golf were ETF, I would short the industry. Today there are 24.2 million golfers. Forecasts by research firms project that by 2030 there will between 21.8 million to 26.1 million golfers. Despite the growth in the US population, the percentage of participation for golf will fall led principally by the growth in ethnic minorities in America. For the past 15 years, more golf courses have closed than open. This trend is expected to continue through 2030.

The attraction to a specific type of golf facility will continue to be predictable and can be traced Maslow’s Hierarchy of Needs.

At the top of Maslow’s Hierarchy is self-actualization. What that translates to for golf facilities is that there will always be a sector of exclusive private facilities, perhaps 2% to 3% of the current 14,613 golf courses, that respect the history and traditions of the game in what is largely a blue-blood environment. It will offer the most challenging golf courses with the finest level of service at commensurable price points. Waiting lists to join by invitation will always be present.

For the other private clubs, historically focused on serving their member’s psychological needs of esteem, accomplishment and gaining the acceptance of others will evolve and will be balanced by the practical requirements of providing for the family a holistic environment for their recreation and social relationships. These mid-tier and entry-level private clubs, representing 20% of golf courses, we anticipate will migrate to offering a diversity of activities focused on wellness. Exercise via golf, tennis, swimming, yoga, fitness facilities, and metabolic training. New services offered will include diet & nutrition, sleep, stress and the quality of life encapsulated in a spa live environment. Dining options and menus will expand catering to the increasing diverse preferences of the member.

Daily fee golf courses and resorts, particularly the high-end, will continue to do financially very well. Comprising 2/3 of facilities, the key change we forecast is empowering the customer to serve themselves. With the cost of labor representing 48% to 52% of total revenue, golf course apps will become all-encompassing from booking a tee time to paying via cell phone upon arrival to requesting the beverage cart to an order in the restaurant. The function of servers will be solely to create a relaxing ambiance, serve food and clean the table. Tournaments, events and the reduction in labor costs is essential for this segment to continue to prosper.

As for municipalities, if the estimated 2,480 facilities were required to operate exclusively as an stand-alone business enterprise without financial support from the general fund, we believe about 60% would close. The Achilles heel for municipalities consists of labor unions, excessive-high fringe benefits, and ineffective governance structure of self-serving Golf Advisory Committees that depress rates through a plethora of season pass and punch card options, the challenge of retention and termination of employees and the election of City Council members, largely volunteers, who have long personal agenda and short backgrounds on how to successfully operate a golf course. No one should view a volunteer as an altruist. Nearly all volunteers have their agendas.

The harsh reality is that every municipal in America could close tomorrow, and golfers would still have a plethora of opportunities to play, albeit more expensive and perhaps more inconvenient to access. Despite these woes, we believe the municipal market will slightly grow as City’s purchase failing golf courses to protect open space to preserve the quality of life for its citizens.

What are the key metric objectives necessary for success?

Three key metrics are demand vs. supply, the level of consumer spending for golf in the facility’s competitive market and the correlation of the slope rating to the MOSAIC Profile Index,

The reason we are not high on the long-term financial success of the industry is that for 35.37% of the golf courses, residents who live within 10 miles of the golf spend less than $1.0 million annually per 18 holes on golf. Even more, telling is that for 43.75% of the golf courses, they have less than 1,000 golfers per 18 holes that live within 10 miles of the golf course. Demand and supply are considered “in balance” with 1,711 golfers per 18 holes nationally or 2,268 golfers per 18 holes with the Top 100 Core-based statistical areas in the United States.

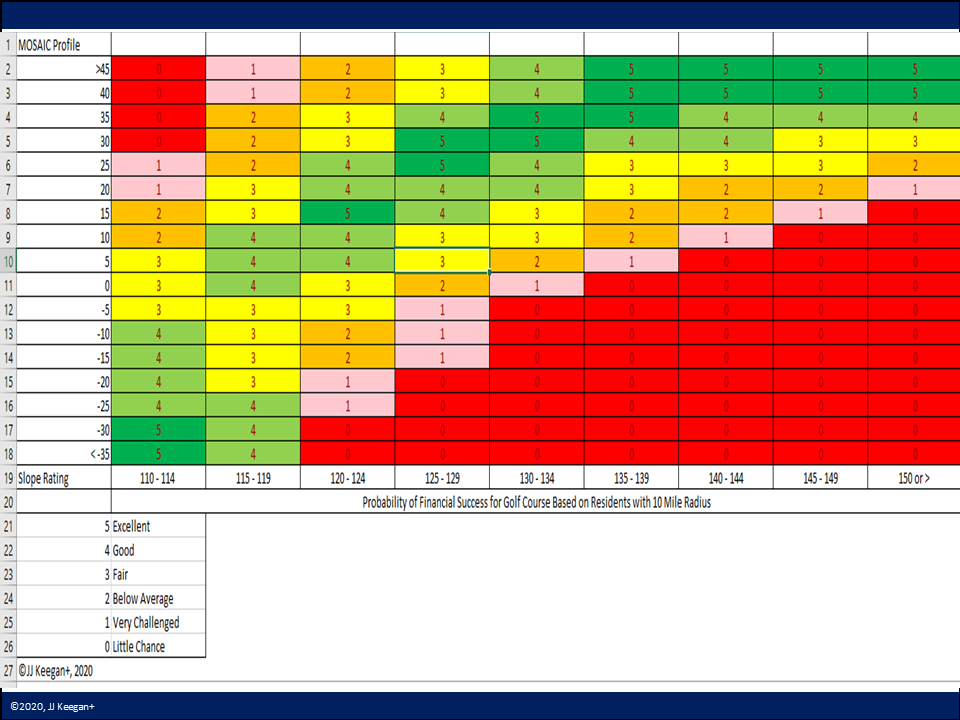

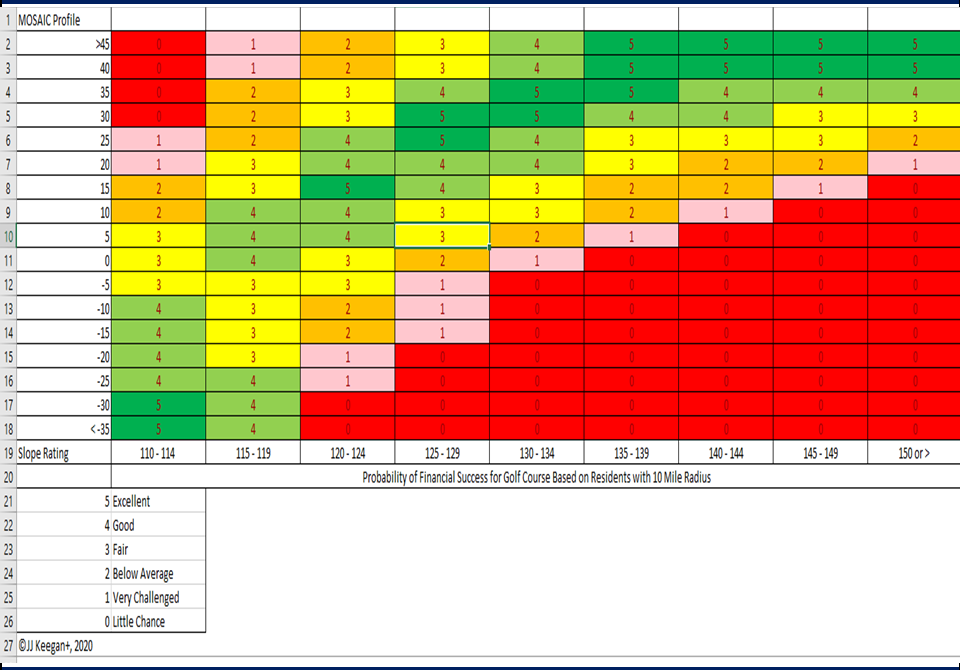

The Experian Mosaic Profile Index measures the attitudinal behavior of consumers towards a certain activity. Presented below is a chart that reflects the probability of success of a golf course based on the relationship of the MOSAIC Profile Index within 10 miles and the course’s slope (challenge) rating:

Beyond the strategic benchmarks, 16 operational metrics helps one evaluate the financial health of a golf course. These key metrics are:

| Key Metrics | |

|

1 |

Gross Revenue: Multiple the prime rate rack times 60%. That result is multiplied by the number of starts. The result should equal your revenue from green fees. |

|

2 |

Yield Per Round: Calculate your revenue per round purchased – total green fee revenue divided by starts compared to prime rack rate. If it is below 60%, you are probably discounting too much. |

|

3 |

Utilization as Percent of Capacity should near 52% |

|

4 |

Green Fee Indicator 1: Multiply the maintenance budget times .0001; the result should equal the green fee. |

|

5 |

Green Fee Indicator 2: Multiply the median household income within 10 miles of the golf course by .00084. The result should equal the green fee. |

|

6 |

Season Pass Fair Market Value: To determine the appropriate rate for season passes, multiply the number of playable days by 32%. That result is multiplied by the rack rate. That result is multiplied by 30%. |

|

7 |

Punch Pass Cards Discount should be 15% of the prime time green fee |

|

8 |

Cost of Goods Sold – Merchandise: 70% |

|

9 |

Cost of Goods Sold – Food and Beverage: 40% |

|

10 |

Salary Expense: Total salaries should be 50% of the total revenue. |

|

11 |

Fringe Benefits: Divide the total fringe benefits by payroll expense. If the number is greater than 40%, you have a problem. |

|

12 |

Maintenance Expense should not be greater than 45% of revenue. Add total maintenance salaries plus all related expenses for the course, i.e., electricity, equipment supplies, fertilizer, gas, water, etc. of revenue. (Based on gross revenue including general fund subsidy) |

|

13 |

Water Expense is ideally $80,000 or less annually. The cost of water should not exceed $1.20 per thousand gallons or $ 387-acre foot. |

|

14 |

Debt becomes prohibitive when it exceeds ten times of targeted cash flow. |

|

15 |

EBITDA: Earnings before interest, taxes, depreciation, and interest should exceed 20% of gross revenue. |

|

16 |

Capital reserves, based on the depreciation of the course’s 13 components plus the clubhouse, should near $250,000 annually. |

What impact do think “alternative” golf facilities such as TopGolf, Drive Shack, and Simulators have on green grass golf facilities?

The market is quickly becoming oversaturated with Top Golf, Drive Shack, Big Shots, and other derivatives. It is my opinion that the market for these alternative facilities is akin to the bowling industry in the 1950’s and 1960’s. Most will be gone by 2030.

As to the immediate impact on green grass facilities, there is mixed evidence. Fifty percent of Top Golf customers have never held a club on their first visit. What concerns means is the variance in the TopGolf age profile vs. that of a green grass golfer show here:

|

Age Classification |

NGF |

Top Golf | Variance |

|

Under 17 |

10.10% | 14.00% | 3.90% |

|

18 – 34 |

24.95% | 53.00% |

28.05% |

|

35 – 44 |

16.40% |

16.00% |

-0.40% |

|

45 – 64 |

30.40% | 15.00% |

-15.40% |

| >65 | 18.05% | 2.00% |

-16.05% |

| 100.00% | 100.00% |

|

What recommendations do you have for Home-Owners Associations considering the acquisition of their neighborhood course?

An HOA is between a rock and a hard place if a golf course within their neighborhood is failing. Though only 20% of the customers are likely to play golf, the closure of the golf course will likely result in a 25% reduction in real estate values for all. Thus, they are obligated to purchase.

First, I would hire a qualified firm like Marcus & Millichap to consummate the transaction. The next professional firm I would hire is a management company, i.e., Casper, Kemper, Touchstone, to manage the facility. An HOA Board has little knowledge or expertise to optimize the financial return of the asset once purchased. The management of a golf course by an HOA Board is a recipe for disaster.