When entering the golf industry in 2003, GolfNow’s mantra was to grow the game of golf. At that time there were 30.6 million golfers playing on 15,443 golf courses.

Believing that the PGA, USGA and the NGCOA were ineffective bureaucratic Associations designed to promote their self-interests through mutual non-cooperation, Golf Now thought the industry was calling out to them like Princess Leia, “Help Me Ob-Wan Kenobi – You Are My Only Hope.”

Today there are 24.1 golfers and 15,204 golf courses falling from a high point of 16,078 golf courses in 2007. That begs the question, “Has GolfNow been beneficial for the golf industry?”

While one could cite the recession and the change in our culture as contributory factors, those factors don’t solely account for the decade-long compression in golf.

We postulate that GolfNow has reached their zenith and that future growth will be very difficult to achieve. We believe this will be positive for golf courses that develop transaction oriented vs. informational websites, maintain robust mobile platforms and adroitly engage in social media using tools like Sumo.me, Leadlander, and Hootsuite to efficiently deploy their marketing efforts. What leads us to this opinion that GolfNow has climaxed?

The following factors weigh heavily in forming our opinion:

- OB Sports recently discontinued using their software with very positive results. The rap video, “We Sell A Boat Load of Trade Time” convinced them to change. We have yet to hear of a firm who has left GolfNow that hasn’t benefitted from the departure. Often, we are told, a golf course realizes an increase in revenue per round after discontinuing GolfNow’s services.

- During the 4th quarter, GolfNow reduced its work-force laying six individuals off in their business to business division.

- The firm is widely held in disregard by many golf course owners and viewed suspiciously by the NGCOA and the PGA resulting in the necessity to form a task force to ensure compliance with fair trade practices. A bad brand will ultimately slay the 10-ton gorilla.

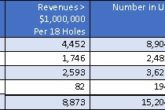

- Over the past decade, they have extracted over $1 billion from golf course owners that generate slightly over $20 billion annually in green fee and member revenues.

- The trade times being liquidated, i.e., over $100,000 in the Las Vegas market on some courses according to ORCA, far exceeds the fair market value of the services rendered.

- GolfNow re-priced a basic POS/TTRS reservation system with limited reporting capabilities (Fore Reservations) that was used by the vast majority of golf courses from a $2,000 annual cash price to a barter based model in which GolfNow often earns 15 times greater revenue without have substantially changed the functionality of the product.

- They are blocking firms that are attempting to access requisite data to develop industry benchmarks data fearing it would show their pricing practices are predatory, don’t enhance a golf course’s average daily revenue per round or increase sales in the aggregate.

- While the PGA of America unfortunately discontinued its monthly PerformanceTrak service as of March 1, 2016, we have heard total many anecdotal reports benchmarking that revenue per available round sold realized by golf courses has decreased as GolfNow has trained the golfer to seek lower prices.

Many pundits speculate that GolfNow is artificially propped up by management companies who receives commissions from trade times sold on their client’s golf courses. Those rebates are retained by the management company for their financial benefit. Talk about a conflict of interest

For those looking for solutions to this dilemma, click here for a quick answer and follow this link to solve permanently the changes you face.

Hilly Bogan

Jim:

I have heard from many course owners that GolfNow has encouraged the “weekend” golfer to expect discounted green fees, to the point that many daily fee users refuse to pay the standard published green fee anymore. If it’s not a perceived to be a deal, then they wont play. This makes it extremely difficult for course operators to achieve margins,

Plus, the first tee time is “comp” to GolfNow with no guarantee of other bookings on the same day. So if for instance, two foursomes were “sold”, and the second tee time went for 50% of published fee, then the operator essentially got 25% of standard rates. Some may be perishable, but certainly not all. This is probably not sustainable.

Some course operators therefore increase the “rack rate” to make it appear there is a deal being offered. Whereas I am all for fair competition, the playing field has changed drastically and now “Joe Six Pack” wants a deal, each and every time. In my humble opinion, GolfNow has not done course operators any real long term favors and has essentially changed the expectations of the consumer.