How, then, does one determine the ideal type of golf experience based on the course location for a golf course that has the opportunity to maximize its investment potential?

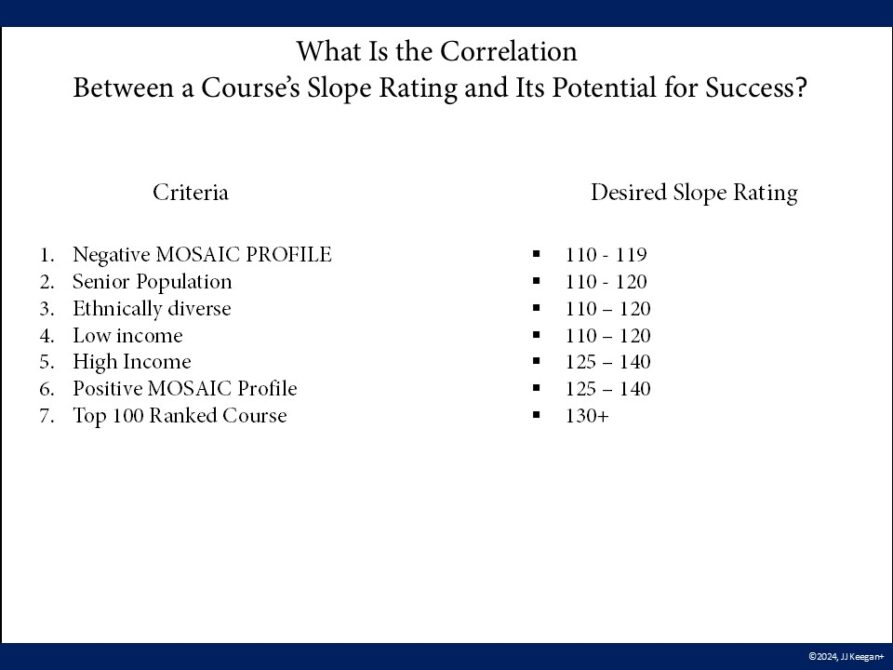

There are a series of seven hurdles that a facility must overcome to be financially successful:

The golf course will inevitably lose money if the MOSAIC profile is significantly negative. If a golf course is in a diverse ethnic neighborhood, it will face economic challenges. Only an entry-level golf course can break even if the population is very young or very old and the income is low.

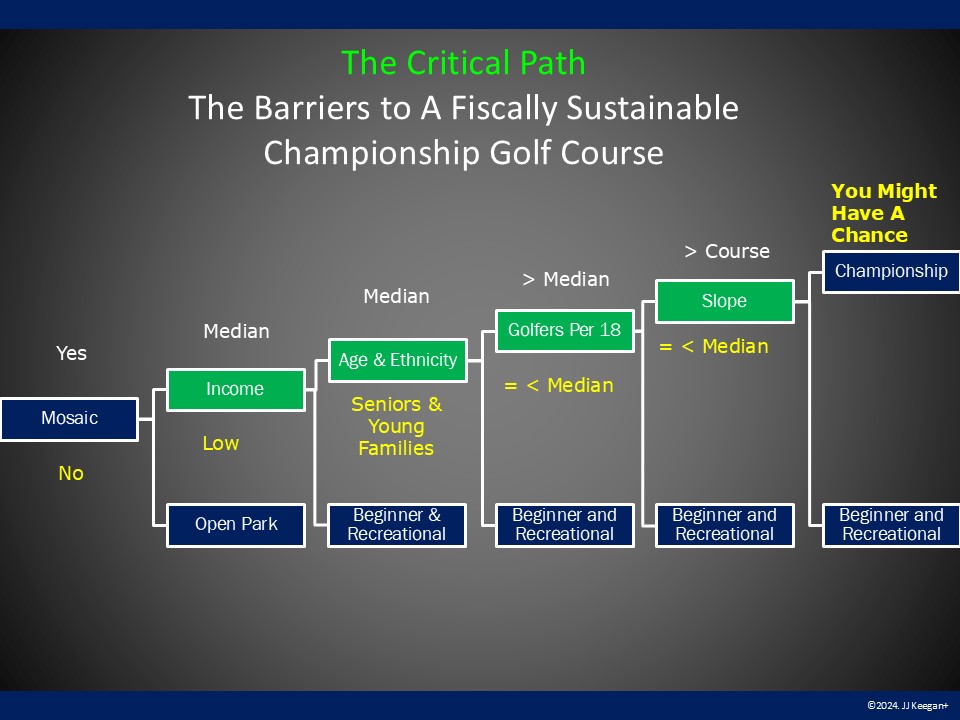

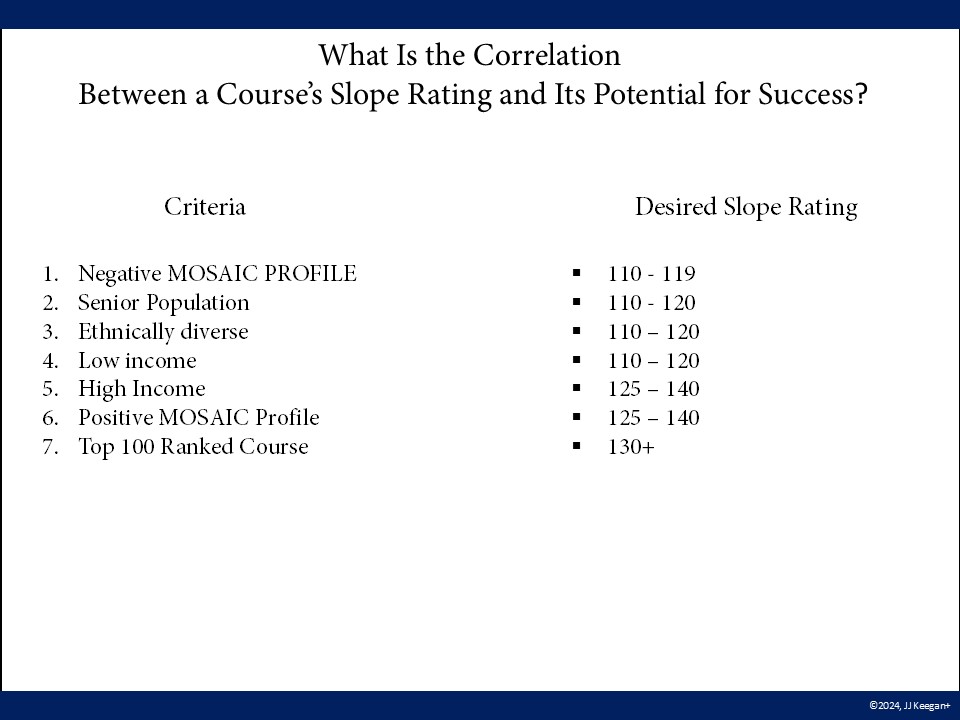

For a golf course to be financially successful, it should be in an area where the MOSAIC profile index exceeds 20%; there is a concentration of middle-aged, well-to-do Caucasians where there are more than 2,200 golfers per 18 holes. Only then can a course anticipate receiving over $75 on a golf course with a slope rating exceeding 130.

It doesn’t sound straightforward, but this conclusion is based on extensive research we have conducted.

Blending demographic factors within the competitive market defines a golf course’s potential. The MOSIAC profile mix, with the age, income, ethnicity, and demand measured by golfers per 18 holes and melded against the slope rating, forecasts the financial potential of 80% of the nation’s golf courses.

Our hypothesis, which is being tested under continuing research, is that each community has an ideal type of golf course based on demographics.

We believe the following correlation exists between the demographics within a 10-mile radius of the facility and the course’s slope rating.

Understanding the unique market in which a golf course operates (the underlying demographics of its customers) is fundamental to maximizing its financial potential.

What to know if your course is optimizing the player experience for golfers within 10 miles of your course, you are welcome to email jjkeegan@jjkeegan.com to learn that insight.