It is not what you think. Though I put in long hours seven days a week, the task I have been trying to accomplish for the past twelve weeks is simple: find a prime tee time reservation for Saturday morning for a foursome within 60 miles of Denver. Not possible.

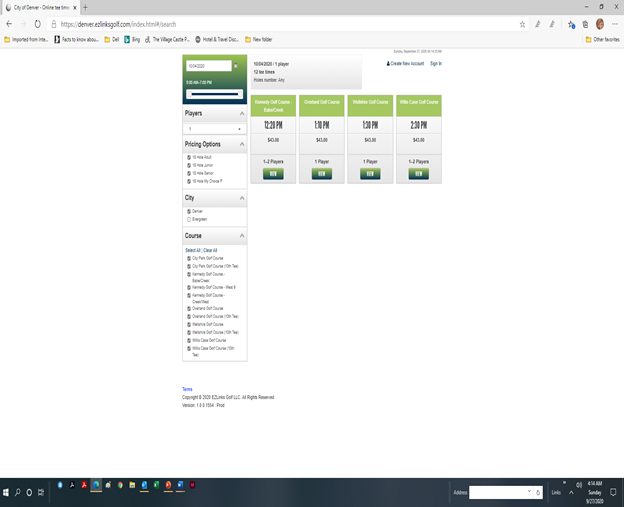

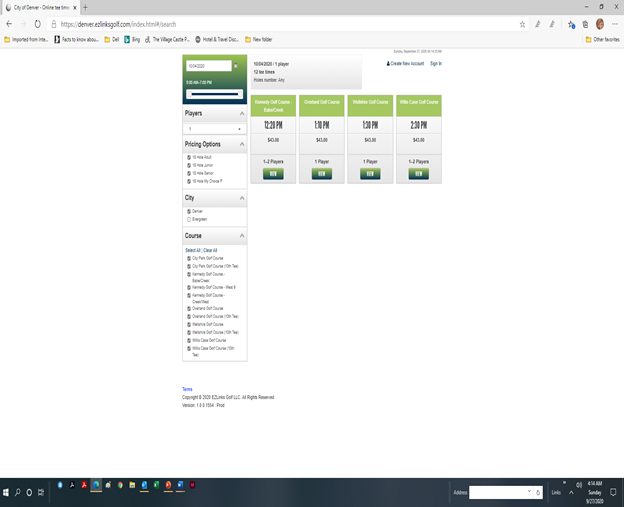

Presented below are the screenshots for golf courses that I tried to book for Sunday, October 11, 2020, from the pedestrian City and County of Denver’s six golf courses to the fabulous Fossil Trace. The results are shown below as to the tee times available:

City and County of Denver – Six Golf Courses – Four tee times for only one or two players:

Fossil Trace: – Sold Out:

We also tried to book the inspiring Riverdale Dunes by Pete Dye that was one of Tom Doak’s first assignments with Perry Dye, and the compelling Ridge at Castle Pines. For both courses – similar results. Tee times are available only late in the day when finishing 18 with the fall season’s diminishing evening light is questionable.

This summer, I have played about 20 rounds as a single getting paired with three other golfers. Lots of tourists visiting friends in Colorado, women, and lots of left-handers. Far greater left hander’s than the 3% statistically determined by True Spec, the leading club fitter in the US.

The challenges of finding a tee time on one of the top five golf courses (Arrowhead, Fossil Trace, Golf Club at Bear Dance, Riverdale Dunes, the Ridge at Castle Pines) I thought was only my problem.

However, the challenge of finding a tee time was made evident to me when I had the delight of being paired at the Ridge at Castle Pines two weeks ago with three golfers: Missy (a member of Blackstone in Peoria, AZ; Lisa D (an LPGA member who teaches at Raspberry Falls Golf Course in Virginia) and Lisa W (the former GM for at Arrowhead Golf Course in Littleton, CO under the watchful eye of Jeff Levine, Senior Vice President, Arcis).

As an aside, I learned that Jeff Levine, who was one of the first to introduce dynamic pricing of tee times at Tour 18 in Dallas and Houston, has a brother (Jordon) who is among the leading personal injury attorneys in Denver. Small world.

These very accomplished players and their husbands who played in the group ahead were to golf in Bend, Oregon. Their reservations were canceled at the last minute due to the unfortunate Oregon fires, which in some cases, limited air travel.

Thus, they were left to scramble for tee times over ten days on the Colorado front range courses. They were utterly shut-out from the best courses, settling for the second tier courses: Murphy Creek, Todd Creek, Lisa W’s home private club the Pinery, and through a reciprocal arrangement, the Mountain Course at Cordillera outside of Vail.

As we approach the “strategic planning season” for 2021 in which green fees, season passes, and tee time reservation policies are to be established, the pain the three ladies and I have suffered provide valuable lessons to golf courses owners concerning establishing prime time green fees rates, season pass pricing, loyalty card sales, and pre-paid punch card programs.

Through August, though most courses were closed for up to eight weeks, rounds are up year-to-date over 2019 by 6%. Play in June, July, and August, according to Golf Datatech, was up 13.9%, 19.7%, and 20.6% respectively over the prior year. While play may not be as robust next year, especially if a vaccine is widely deployed, we are confident that golf course owners should approach 2021 as though demand will remain high.

Note that the nattering nabobs of negativity will cite the “legs of COVID-19” are unknown as to its impact on 2021 rounds, and thus rates should remain unchanged.

We believe it easier to offer a discount off a prime-time rate in which the customer feels that they are getting additional value, then increase the price higher than the prime-time rack rate based on demand. To err on raising rates too high while 2021 demand is unknown is a prudent strategy Del Ratcliff of Ratcliffe Golf Services advocates.

Here are some recommendations that will result in your course perhaps doubling its EBITDA (earnings before interest, tax, depreciation, and amortization).

Prime Time Green Fees: Implement a 20% increase in green fees. With the average rate for prime-time green fees with cart at $49, the base rate should be posted at $58.80. This increase of $9.80 will result in REVPAR increasing by $5.88. Based on average rounds of 32,000, EBITDA will increase by $188,160, representing nearly a 100% increase in a course’s free cash flow depending upon your particulate market position.

Season Passes: While the astute golf course operator doesn’t offer this program, it would be foolhardy of me to dismiss a revenue program offered by over 70% of golf courses. A compromise would be to grandfather existing season pass holders. Rock Lucas, PGA, CGCSA, NGCOA, and owner of Charwood Golf Club is ahead of the curve and wisely grandfathered pass holders several years ago. We categorically reject the notion that a golf course is required to sell season passes to provide sufficient off-season cash flow.

The suggestion is to raise the “break-point” on season passes from 20% of playable days to 30% and reduce the embedded discount from 30% to 25%. The statistics of playable day utilization and program discounts were determined based on a national survey by our firm in 2019.

Here is the formula some golf course managers use at northern golf courses: 200 playable days times 20% utilization with a 30% discount. The price of the season pass with cart based on this formula is $1,344. Southern courses often use 280 playable days at the base rate, which values the season pass with the cart at $1,881.

If the suggestions are followed, the typical northern courses will post a season rate with a cart of $2,160, while southern courses would raise their rates to $3,024. Considering the typical golf course sells 60 season passes, the revenue increase might be $48,960 for the northern courses and $68,560 for the southern facilities.

Del Ratcliffe, Ratcliffe Golf Services believes, “The VAST majority of round increases due to COVID implications have taken place on WEEKDAYS, not during peak periods. I think any previous formulas for discounting are out the window for the next 12 months and potentially 24 or more. Why discount ANY when you are filling your tee sheet at rack rate during weekdays?”

Loyalty Cards – Is loyalty a good thing? Not necessarily. The key to loyalty programs is to measure the incremental revenue derived from the frequent customer vs. the cost in the discounted rates provided. The opportunity cost of providing access to a frequent customer vs. the revenue that could be achieved from the public player must also be considered.

The permutations for loyalty card programs are numerous. If one wants to see what not do, reviewing the loyalty programs at a municipality is a good place to start.

Most loyalty programs offer complimentary registration. Features of the Denver Golf Loyalty Program (https://denvergolfpasses.com/product/loyalty/) that requires a one-time $20 registration fee includes:

- Make tee times 14 days in advance

- Accumulate points at any of Denver’s eight locations

- Earn points with every dollar you spend on your green fees

- Your points are kept on our point of sale system…no more vouchers to lose!

- Redeem points for green fees whenever you have enough or save them for later

- Points never expire!

- A portion of each purchase goes to support the First Tee of Denver

The redemption of points represents a 10% discount as explained on the Denver website https://www.cityofdenvergolf.com/loyalty_program/:

“You can use your points at any time or course to pay for green fees when you have enough to redeem the round. Generally, 10 points will equal approximately $1 toward your green fee. (EX: I want to play a round that costs $30, if I have 350 points, I can use 300 points to pay for my round and have 50 points leftover).”

Denver would have to produce greater than an 11.11% increase in rounds for this program to be economically prudent. Not likely considering the current utilization of their courses are at capacity. When demand slows, Del Ratcliffe highlights that achieving these additional rounds will be even more challenged.

Pre-Paid Punch/Discount/Premier Cards – Allowing a golfer to pre-pay for a stipulated number of rounds doesn’t make sense to me or to Rock Lucas, who abandoned utilizing this form of discounts several years ago.

One only needs to analyze the City of Aurora’s website (https://auroragov.org/things_to_do/golf/gift_cards___premier_cards) to understand why such programs are revenue dilutive. The Aurora website states:

“Stop paying full price for GOLF. Purchase your Premier Card HERE.”

Your premier card is accepted at all five Aurora golf courses. Use it for green fees, golf carts, range balls, and rental clubs. The card NEVER expires, it’s transferable, and you don’t have to be an Aurora resident to purchase one.”

The Aurora program offers the following discounts:

| You Pay | Added Value | You Receive | Discount | Increased Rounds Required to Derive Same Revenue |

| 150.00 | 25.00 | 175.00 | 16.67% | 21.33 |

| 250.00 | 50.00 | 300.00 | 20.00% | 25.00 |

| 500.00 | 125.00 | 625.00 | 25.00% | 33.30 |

| 150.00 | 50.00 | 200.00 | 33.33% | 48.33 |

When courses are operating at capacity, someone, please explain to me that offering discounts of this magnitude is in the golf course owner’s financial interest.

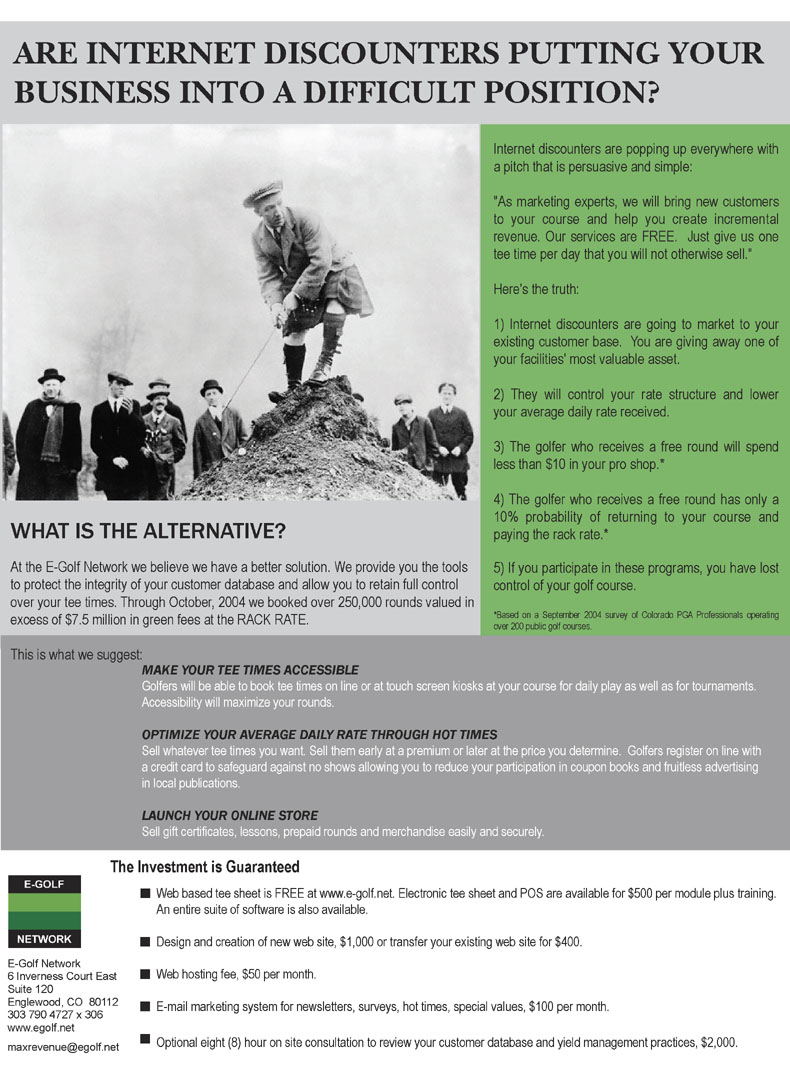

Barter: The judgment of any golf course owner, which is exchanging tee times for technology, has to be seriously questioned. The best golf course operators, like Del Ratcliffe, Rock Lucas, and Don Rea, owner of Augusta Ranch, have abandoned barter.

They agree you are trading an expense that will not exceed $10,000 through the acquisition of a comprehensive golf management system from one of the leading vendors (Club Caddie, Club Prophet, ForeUp, Lightspeed) by forfeiting revenue averaging $30,000 per course plus putting downward pressure on your rate structure via discounting.

We can’t understand why golf course owners didn’t heed the warning on the perils of barter we issued nearly two decades ago, as reflected in the advertisement below that was widely distributed throughout the industry.

When courses are operating a capacity, someone, please explain to me have offering discounts of this magnitude is in the financial interest of the golf course owner.

When courses are operating a capacity, someone, please explain to me have offering discounts of this magnitude is in the financial interest of the golf course owner.

The Simple Answer that is Complicated: Dynamic Pricing

The simple answer is to implement dynamic pricing and let the rates, like airlines and hotels, float to match market demand. Don Rea just completed a huge deep dive into their rates, programs, and passes. “We have been dynamically pricing our tee sheet for many years, and now with benchmark data available and utilizing three years’ worth of historical tee sheet data, we have seen a very healthy increase in REVPAR.”

Unfortunately, dynamic pricing is not effectively integrated into any POS System. A software firm that offers dynamic rate management seems promising, but I lack the confidence to endorse the integrity of its owners based on personal experience. Further, they have appeared to struggle during COVID-19 to increase market share based on reports recently.

However, the astute Michael Vogt, CGCS, has developed a pricing template. This is simply marvelous in guiding the golf course owner to properly price their inventory by day, by week, and throughout the year. Mike’s focus is determining the cost of operation and embedding a mark-up to ensure earnings targets are achieved. This template is available for $50. Click here:

The Tailwinds Are Clear

For 2021, season pass offers, loyalty programs, and pre-paid punch cards should be discontinued. If offered, none should be providing “advanced access” to the tee times over the rack rate-paying golfers. Further, a credit card should be taken for all reservations and no-shows and short-shows diligently charged. This will change the culture in the golf industry that is long overdue.

If three smart operators, Del Ratcliffe, Rock Lucas, and Don Rea, have already implemented as part of their 2021 strategic vision, these ideas, don’t you think it prudent to do so also?

If you need help setting your 2021 rate structure to consider local demand in your market, and the likely 2021 weather forecast offered through Weather Trends Intl, please call. It would be our pleasure to guide the creation of an economical rate program for next year.

Lead Author: James J. Keegan, Envisioning Strategist, and Reality Mentor. His sixth book, “The Winning Playbook for Golf Courses: Shorts-Cuts for Long-Term Financial Success,” was released on June 20, 2020, at jjkeegan.com/product-category/book-store/. Keegan was named one of the Top 10 Golf Consultants and Golf Advisor of the Year in 2017 by Golf, Inc. Keegan has traveled more than 2,984,000 miles on United Airlines, visiting over 250 courses annually and meeting with owners and key management personnel at more than 6,000 courses in 58 countries.

Contributors: Del Ratcliffe, Ratcliffe Golf Services; Don Rea, Augusta Ranch Golf Club; and Rock Lucas, Charwood Golf Club, and Harvey Silverman, Silverback Golf.