This passion has led me on a life-long journey to learn how one creates value for golfers on a foundation that optimizes the financial performance of a golf course.

Whether it is because I earned a BBA from TCU, an MBA in Finance from University of Michigan, was a Captain in the USAF Audit Agency, a CPA for the KPMG or merely because I am a Virgo, I am committed to finding a ‘holistic’ formula that golf course owners can implement to ensure the financial success of their golf course.

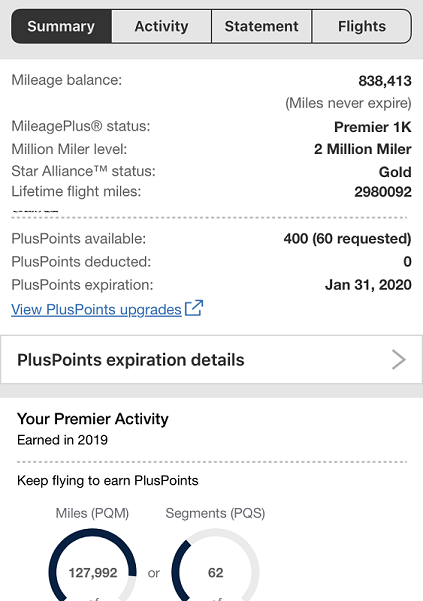

Having toured over 5,000 golf courses in 58 countries, 15 countries in 2019 alone to find that answer, as part of our year-end reflection as to what 2020 may bring, it is with a sense of amusement that I have spent 1.18% of my entire life in the air on United Airlines planes. Combined with five years of my life (1,825 days) staying at Marriott hotels, I realize that the ultimate financial success of a golf course rests principally with the owner and management team. It is pure and simply a business, albeit a small one at that.

There are certain elements, many uncontrollable, that have a substantial influence on the ability of a golf course management team to achieve success. Here are ten hurdles golf courses face to achieve financial success and suggestions on how they navigate these challenges.

1. Golf is perceived as an elitist sport.

The median household income of a golfer is 50% greater than that of the average citizen.

Golf’s brand is perpetuated by the Top 100 rankings, the proclamation of yesterday’s and today’s architects as deities, the exclusive image perpetuated by private clubs, and the unwarranted focus on the rules and dress codes, particularly at public golf courses. These practices appeal to 10% of the golfers and put off 90% of individuals who are contemplating engaging in the sport.

While the constant refrain that golf is too difficult, takes too long and is too expensive, those excuses are offered to mask the golf’s elitist attitudes in which embarrassingly in a country with 51% females, perhaps only 2% are females. Less. than 300 females and 250 minorities are represented in the 28,000 PGA membership. Note that among those who play, 8% of the population, golf comprises 76% males and 24% females.

Recommendation – Embrace that golf is an elitist sport. Charge fees commensurate with the experience created. Eschew discounting the product. Ski resorts offer few discounts. Neither should golf. Here is an interesting article published in Golf Digest, “Am I Too Poor to Play Golf? Click here

2. It is important to understand the product/service being sold.

Nearly all within the industry believe that they are in traditional form of the golf business steeped in history when, in fact, they are in the entertainment business providing a venue for fun amongst family and friends so they may spend time outdoors and enjoy physical activity.

Golf has failed to grasp the correlation between Maslow’s hierarchy of needs, the social platform on which their customer resides and the experience they desire. For the masses, golf is a gathering place for an individual to reflect on one’s inner spirit and to bond with family, friends, and associates. Have you ever stood on the 1st tee and watched golfers tee off for an entire day? The average golfer is awful with a swing that looks like nothing you see on TV.

For the public golfer course, until golf changes its clubhouses from institutions with formal professional shops to open and welcoming sports bars that accept tee times, sell merchandise and food, it will struggle.

Recommendation: Understand that golf is not a game; it is a lifestyle.

3. The Industry would benefit from “Invisible Hand” to guide It. The focus of Golf Associations is principally self-preservation launching that they believe will benefit their membership. It is my thought that Associations work at odds and not in concert with one another.

Associations expect donations for the “good of the game” from golf courses to contribute free access to their facilities or of volunteers as officials for tournaments, rangers, starters, etc. Courses and Individuals are seduced by what they perceive as a value in affiliating with an Association where the benefit may be illusory.

Recommendation: An organization should be formed that meets quarterly that comprises the President of the USGA and the R&A, Commissioners of the Executive of the PGA, LPGA and European Tours, the Chief Executive Officers of the ASGCA, CMAA, GCSAA, NGCOA, and NGF. An individual should be elected that speaks for the entire in the aggregate. Not that this will never happen due to the egos that exist between the allied associations.

4. Equipment manufacturers complicate rather than simply the purchase decision.

With annual releases that promise longer distance with greater accuracy, they offer such a multitude of different models couched in highly scientific terms that the layperson is challenged as to the proper club to buy.

With the cost of a properly fitted set of clubs exceeding $5,000, the vast majority of golfers play with equipment that is over seven years old and is ill-suited for them making a challenging game even more difficult.

Recommendation: The bifurcation of equipment to make the game easier for the masses would broaden the appeal of the game. The short game will always comprise 50% of the strokes played. The short game, in which everyone can play, will provide the differentiation for competition.

5. The workforce is customer service neutral.

The vast majority of those employed in the golf industry selected the profession for their love of the game. Educated and skilled business professionals comprise less than 20% of the workforce. Can you name one time when you said, “I am going to this golf course because of the service I received?” I can’t.

Recommendation: The assembly line of golf, from the time an individual contemplates making a tee time until the time they depart, has between 12 – 15 customer touchpoints, depending on the type of facility, i.e., municipal or exclusive private club. Automation, of as many of the customer touchpoints as feasible, would improve not lessen the customer experience.

6. Data published within the industry lacks credibility.

Studies published by various organizations never state the degree of confidence or the margin of error in the research provided. The number of rounds played is a broad-based estimate calculated based on a rough estimate made in 1990 with increases or decreases reported annually based on unverified reporting from 25% of the courses. The same broad estimate is made for golfers, based on varying definitions of what is a golfer.

The reports published by some Associations are viewed with skepticism as they have a “Chamber of Commerce” blue sky orientation.

Benchmarking, to the credit of the PGA and Club Benchmarking, who have developed marvelous systems, is vastly underutilized with less than 10% of facilities reporting. Determining meaningful financial statistics for comparison to facilities is haphazard.

Recommendation: Reports published should include the degree of confidence and the margin of error contained within the report. Research organizations should not be in the consulting business for the conflict of interest it creates.

7. Pricing models are flawed.

Golf is vastly underpriced for the quality of experience provided.

Golf courses set prices based on the least a golfer is willing to pay, hoping to entice the last incremental round possible rather than what the majority can afford. Golf courses rarely set prices based on the cost of the experience provided to include the capital reserves required to maintain an asset that has, at best, a 30-year life cycle.

Name another consumer product that provides rates based on the time of the year, the time of the day, the customer type consolidated into multiple offerings of season passes, punch cards, email specials, barter times that is successful? A typical golf course offers over 100 different rates for the same product.

Compounding the price model flaw is that utilization of golf courses hovers around 48% contrasted to hotels and airlines who target 80% utilization for profitability. The abundance of golf courses has course operators struggling to earn the last dollar to be cash-flow neutral. Golf courses are discounting to their ultimate demise.

Fortunately, for daily fee operators, their greatest asset is the raw value of the land and the opportunity to convert it to commercial or residential development.

Recommendation: Green fees should be set based solely on the day of time of the year, day of the week and time of the day. Offering season passes, punch cards, and rates based on age and gender should be discontinued. Senior rates should be discontinued considering that weekday rates are already lower than weekend rates.

8. Labor expenses are a disproportionate part of the cost of operation considering the massive capital investment to operate the facility.

The operation of a golf course is largely labor dependent. With the majority of golfers interacting with a plethora of low-wage hourly seasonal workers, i.e., bag drop, check-in, starter, ranger, beverage cart attendant, club cleaner, waitress/waiter, cashier, creating an enlightened customer experience is a challenge.

Compounding the difficulty of providing a consistent experience is that the customer adversely impacts the quality of the product, the course operator may desire to provide. Is the golfer maintaining a proper pace, did they repair ball marks, rank the bunkers, replace the divots or damage the green in anger missing a putt that they had a small probability to make?

The owner of the facility has little actual control over the consistency of the actual experience delivered to the golfer.

Recommendation: Geocoding social media apps that alert staff when a regular golfer/member is on the property, check-In kiosks, table food ordering systems, and auto-generated customer/ member surveys hold the key to control labor costs.

9. Software firms over promise and consistently fail to deliver timely. Technology is sold as a finite solution when, in fact, it is an infinite product whose development is never-ending. The ideal technology solutions don’t exist today. If they did, the staff at the course would find a reason not to fully utilize it.

Software firms compound these problems by promising the next release will be the end-all solution when, in fact, it will provide incremental, not exponential benefits.

The return on investment from software to an industry that has only 14,613 potential clients is too low with the cost of development too high for an ideal solution every to be delivered.

Recommendation: Abandoning barter and charging golf courses fair market value in cash for the solutions-based software with appropriate assessed for custom development is a start.

10. Municipal golf courses are marketed as the entry door to the game. They serve as the buoy in the lake on which the entire industry floats.

From Golf Advisory Committees comprising avid golfers who suppress rates, demand preferred access and seek champagne while only having a beer budget, to municipal employees who work for the fringe benefits exhibiting few professional courtesies to golfers or third-party vendors, to City Council members who know little of the business and are more interested in placating their constituents than operating a fiscally solvent business, the entire procurement, operational, organizational structure and management of municipal golf courses renders the successful operation a challenge.

Municipal golf largely thrives because they are located in large population centers where demand vastly exceeds supply.

Recommendation: With only one citizen in seven playing golf, municipalities should be held accountable to generate sufficient cash flow to service debt and fund capital improvements without financial support from the general fund. If they aren’t able to operate as financially independent entities, the golf course should close.

Final Thoughts

A leading golf course operator of a multi-course municipal sent me a riddle as I was concluding this blog.

“How does one spend ten years in the golf business and end up with $1,000,000? Answer. Start with $2,000,000.”

He wrote that “labor shortages, at least in public golf, the price needs to go up to pay for staff or the jobs can’t get done. People have not idea what it costs to provide the 150 acres plus, of green open space on which to play the game of golf. The profession, in my view, needs to step up and educate its customers.”

Another industry insider wrote me on December 27, 2019 “For what it is worth I think that any golf operation grossing below $800K is going to have a challenge in making it in today’s world. The increased cost of labor (where market conditions, forget about minimum wage laws) are pushing wages well beyond the range we are offering for positions such as cart attendants, increased costs of maintenance equipment, fertilization, pesticides, water use, the list goes on and on – continue to constrict the gross profit margins of any operation below that number. For a single-owner facility, where the owner is behind the counter or on the mowers him/herself, it is more feasible, but as a business model it is tough. The revenues have to come up in this operation unless it is going to continue to be subsidized.”

A third industry pundit wrote, “Golf courses need to charge more and stop kowtowing to the lowest common denominator. Simplify the rate structure. Drop senior rates. I’ve said for years that the idiot who first offered senior rates at 55 should be hung in effigy at the PGA show.”

As I write this blog on the longest day of the year, having just got off a 28-hour trip from Dubai, perhaps my vision is clouded in the darkness of the day and the limited light. Can you shine a ray of hope in the industry? Please comment below as to your thoughts to improve the financial health of golf courses.